US wind turbine suppliers predict extended repowering wave

Turbine and tower advancements could sustain repowering activity into the next decade, outweighing the impact of falling tax credits, leading suppliers told New Energy Update.

Related Articles

U.S. demand for wind repowering is surging as operators rush to maximize asset returns amid dwindling production tax credits (PTCs).

Leading U.S. turbine supplier GE Renewable Energy has repowered 4 GW of U.S. wind capacity at 36 wind farms since 2017 and expects to repower a further 3 GW of capacity at 25 windfarms by the end of 2020, the company said in May. Recent customers include NextEra, MidAmerican Energy and E.ON.

Denmark's Vestas, the second largest U.S. turbine supplier in 2018, has contracted 725 MW of U.S. repowering projects since the start of 2017, with 300 MW due for completion this year and the remainder in 2020.

German group Siemens Gamesa has completed 500 MW of U.S. repowering projects since the start of 2017 and is scheduled to complete a further 1 GW of projects by the end of 2020.

The 10-year PTC is set at $23/MWh for projects completed by 2020, then falls by 20% per year. This step down in credits is spurring many operators to repower assets half-way through their provisional 20-year lifespans.

Turbine advancements are also driving up repowering demand by boosting power output, reducing maintenance costs and extending production life. In 2018, over 15 GW of US wind capacity was "ripe" for repowering, ICF consultancy said in a report.

In some cases, repowering projects can increase annual energy production (AEP) by a quarter, leading turbine suppliers told New Energy Update.

Looking ahead, further improvements in turbine technology could offset falling PTC income and extend repowering demand into the 2020s, suppliers said.

Higher returns

Repowering allows operators to install larger, more efficient turbines and introduce operations and maintenance (O&M) improvements.

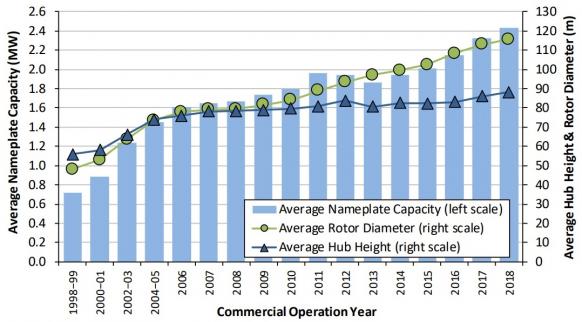

Average US wind turbine nameplate capacity, dimensions

(Click image to enlarge)

Source: Department of Energy's 2018 wind technologies market report, National Renewable Energy Laboratory (NREL).

Operators may choose to perform a "full repowering" of major wind farm infrastructure or a "partial repowering" where typically the existing tower and foundations remain in place.

In 2017, MidAmerican Energy Company launched a $1 billion plan to repower seven wind farms in Iowa commissioned between 2004 and 2008. MidAmerican expected AEP to increase by 19%-28% across the seven projects, depending on site-specific factors.

Siemens Gamesa's full repowering projects increase AEP by between 10 and 26%, depending on the project, Juan Nicolas Salamanca, Director of marketing for North America at Siemens Gamesa, told New Energy Update.

These work packages can lower the levelized cost of energy (LCOE) by 10 to 15%, he said.

Siemens Gamesa’s upcoming projects include the repowering of MidAmerican's Rolling Hills project in Iowa. Siemens Gamesa will install 163 SG 2.7-129 turbines to operate at 2.38 MW, as well as 18 SWT-2.3-108 wind turbines, raising the capacity at the facility to 429 MW. For all of the units, the blades, hubs and nacelles will be replaced by late-2021, while the top tower sections will also be replaced for the SG 2.7-129 units.

Site-specific factors often favor partial repowering, providing significant efficiency improvements at lower cost.

Partial repowering of hardware can increase AEP by up to 10%, while improved software and power electronics can boost production by up to 7.5%, Salamanca said.

Projects installed between 2003 and 2010, underperforming plants and those with high maintenance costs were all likely candidates for partial repowering, ICF said in its 2018 report.

"The installation of larger diameter rotors and higher nameplate capacity generators on existing towers and foundations make them more efficient," Chris Mertes, Renewable energy manager at ICF consultancy, told New Energy Update.

“Composite technology has evolved and paved the way for longer, lighter turbine blades. At the same time, turbine controls and optimization have helped improve loadings," he said.

O&M grab

Repowering projects allow original equipment manufacturers (OEMs) to secure long-term service contracts with asset owners.

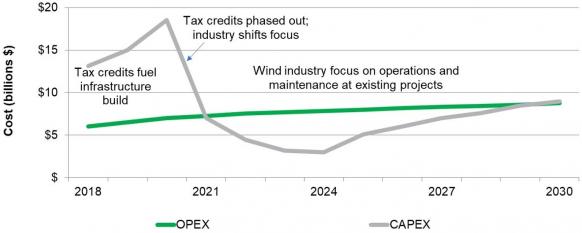

Intense price competition has squeezed suppliers margins and OEMs are seeking a greater share of the growing operations and maintenance (O&M) market. Annual investments in wind O&M in U.S. and Canada is forecast to rise from $5 billion-$6 billion in 2018 to $7.5 billion by 2021, eclipsing capex spending for the first time, according to IHS Markit. Data analytics can generate significant savings and turbine suppliers have increased their spending in digital products to boost their service offerings.

Forecast North American wind opex vs capex

(Click image to enlarge)

Source: IHS Markit, September 2018.

In one example, Vestas signed a twelve-year AOM 4000 full-scope service agreement as part of a new contract with PacifiCorp to repower 459 MW of capacity at the TB Flats I and II projects in Wyoming with 4.3 MW turbines. The AOM 4000 service agreement is based on a time-based availability guarantee, which compensates the operator when availability falls below contractual thresholds of up to 97% availability.

The TB Flats I and II deal followed Vestas' recently repowering of 260 MW of turbines at PacifiCorp’s Marengo and Marengo II wind projects in Washington. The owner of Pacific Power and Rocky Mountain Power, PacifiCorp plans to invest $3.1 billion to repower over 1 GW of wind capacity by 2020.

Long-term service contracts allow Vestas to leverage economies of scale by optimising spare parts inventories, supply chain facilities and labor, Chris Brown, President of Vestas sales and service operations in North America, told New Energy Update.

Combined with component advancements, these gains can reduce operational expenditure [opex] by 10 to 20%, "depending on current technology vs. the new Vestas technology," Brown said.

Post 2020

Despite falling tax credits, repowering activity is set to continue as assets age and turbine technologies improve.

IHS Markit predicts the average age of U.S. wind turbines will rise from seven years in 2018 to 14 years in 2030. Annual U.S. wind repowering investment could reach $25 billion by 2030, according to the U.S. National Renewable Energy Laboratory (NREL).

“The demand for repowering projects will continue beyond 2020 for the 80% and 60% PTC phases,” Salamanca said. “Even though the demand will not be as comparable to the 100% PTC cycle, there are significant opportunities for benefiting from the repowering solutions.”

Vestas expects repowering demand to remain steady through 2021 as operators take advantage of the 80% tax credit, while technology improvements could boost demand further out, Brown said.

“New technical innovations related to tower life extension could create opportunities to economically repower existing projects utilizing 60% or 40% PTC," he noted.

As tax credits fall, owners will typically use repowering to upgrade older assets towards the end of life spans, or obsolete turbine technology, Brown added.

The removal of PTCs will remove a significant incentive to repower earlier in the asset's life-cycle, Mertes said.

“Instead, decisions to repower will be made based on the project’s economics,” he said.

By Neil Ford