US Senators demand 30% offshore ITC extension; Global offshore wind pipeline grows to 261 GW

Our pick of the latest wind power news you need to know.

Related Articles

US Senators submit bills to extend offshore wind tax credits at 30%

U.S. East Coast senators have submitted to Congress two separate bipartisan bills aimed at extending investment tax credits (ITCs) at 30% of project value for as much as eight years.

The bills are designed to support industrial growth and job creation in the early years of U.S. offshore wind deployment.

Under the current legislation, the ITC for offshore wind drops from 18% for projects starting in 2018, to 12% for projects in 2019 and 0% from 2020.

On July 2, U.S. Senators Susan Collins (Republican(R)-Maine) and Tom Carper (Democrat(D)-Delaware) introduced a bill that would extend the ITC at 30% for projects starting construction by the end of 2026, or the year after U.S. installed capacity surpasses 3 GW if this occurs later.

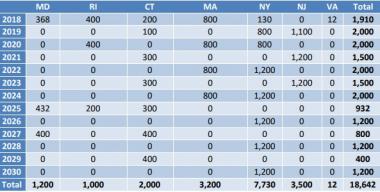

Forecast US offshore wind contracts by state

(Click image to enlarge)

Source: University of Delaware's Special Initiative on Offshore Wind, March 2019

The legislation is co-sponsored by Senator Angus King (I-ME) along with Senators Sherrod Brown (D-OH), Ben Cardin (D-MD), Chris Coons (D-DE), Bob Menendez (D-NJ), Jack Reed (D-RI), Brian Schatz (D-HI), Elizabeth Warren (D-MA) and Sheldon Whitehouse (D-RI), Collins and Carper said in a statement.

A week earlier, Senators Edward J. Markey (D-Massachusetts) and Sheldon Whitehouse (D- Rhode Island), and Congressman Jim Langevin (Rhode Island-02) had reintroduced legislation that would extend the ITC at 30% for six years.

Senators co-sponsoring this bill include Jack Reed (D-R.I.), Elizabeth Warren (D-Mass.), and Cory Booker (D-N.J.), the proponents of the bill said in a statement.

“At this critical moment for a new U.S. energy industry, policy stability is more important than ever," Tom Kiernan, CEO, American Wind Energy Association, said.

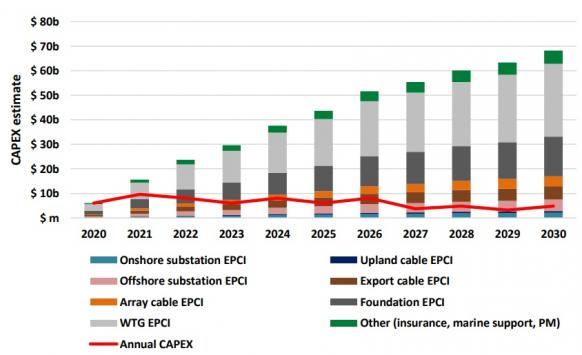

"We appreciate and strongly support proposals that would extend the ITC for offshore wind, jumpstarting the projected $70 billion build-out of America's offshore wind infrastructure, delivering large amounts of reliable, homegrown clean energy and tens of thousands of jobs to the U.S. economy,” he said.

The value of the U.S. East Coast offshore wind supply chain is forecast to hit $68 billion by 2030, the University of Delaware said in a report earlier this year.

Orsted, EEW propose offshore foundation factory near Philadelphia

Denmark's Orsted has signed a Memorandum of Understanding (MoU) with German steel pipe manufacturer EEW to potentially develop a monopile fabrication factory in Paulsboro, located on the Delaware River just outside Philadelphia, according to media reports.

The proposed foundation facility would support Orsted's giant 1.1 GW Ocean Wind project, selected by New Jersey to be the state's first ever large-scale wind farm. As East Coast offshore wind activity grows, Paulsboro could become a key manufacturing hub, media reported.

Value of US offshore wind supply chain

(Click image to enlarge)

Source: University of Delaware's Special Initiative on Offshore Wind, March 2019.

Last month, the New Jersey Board of Public Utilities (NJBPU) selected Orsted to negotiate a 20-year offshore wind renewable energy credit (OREC) for Ocean Wind, following a competitive tender which saw bids from groups such as Norway’s Equinor and a joint venture between Shell and France's EDF Renewables.

Due online in 2024, Ocean Wind is the largest single U.S. offshore wind procurement to date and matches the size of Europe’s largest projects.

The world's leading offshore developer, Orsted plans to increase its installed capacity from 5.6 GW to 15 GW by 2025.

The U.S. offshore sector must create regional East Coast supply chains and public-private initiatives that accelerate training and port investments to ensure long-term competitiveness, leading developers told the U.S. Offshore Wind 2019 Conference last month.

To become competitive, the U.S. offshore wind sector must take a wider regional approach to supply chain buildout and work with U.S. institutions to create hiring and port infrastructure solutions, developers said.

Global offshore pipeline grows as new markets open up

The global offshore wind development pipeline has grown to around 261 GW, according to a new report from Wood Mackenzie Power and Renewables.

Seeking higher returns, European offshore groups are expanding into emerging markets such as the U.S., Taiwan, Poland and Ireland. Falling offshore wind costs and proven deployment have also lured oil and gas majors and institutional investors into the market.

In the U.S., European developers have built alliances with local groups to gain a competitive edge.

Some groups have acquired regional developers. Denmark's Orsted, the leading global offshore wind by capacity, recently acquired 100% of U.S. group Deepwater Wind, raising its U.S. development pipeline to almost 9 GW.

The shift away from feed in tariffs to competitive auctions is spurring developers to form bidding consortiums to win projects, Wood Mackenzie noted.

"Almost 90% of companies participating in tenders in 2019 are expected to participate through consortiums," it said.

China's 84 GW offshore wind development pipeline remains dominated by Chinese firms, with only one European company securing a project pipeline in the country, Wood Mackenzie said.

New Energy Update