Turbine majors use data, inventory learnings to win multi-brand deals

Leading wind turbine suppliers are combining digital solutions with supply chain and inventory learnings to win third-party service contracts in the hotly-contested operations and maintenance (O&M) market.

Related Articles

The market for multi-brand service contracts has become a new battleground for turbine suppliers seeking to increase their share of the growing operations and maintenance (O&M) market.

Denmark's Vestas is the largest global supplier of multi-brand services and has over 6 GW of third-party capacity under contract across 18 countries. Other suppliers are expanding in this area and recent contracts include Siemens Gamesa's four-year O&M agreement with Pattern Energy for its 218-MW Panhandle Wind 1 facility in Texas. Siemens Gamesa will maintain 118 units of 1.85-87 MW GE wind turbines and will use analytics, scale and flexibility to improve asset performance, it said.

To win service contracts, OEMs must fend off competition from independent service providers (ISPs) and in-house operator teams.

OEMs benefit from their technical expertise and scale, but the shift towards multi-brand service contracts brings about wider spare parts challenges. Spare parts costs can represent up to half of O&M costs and operators view spare parts procurement capability as a crucial factor when selecting their service provider, according to a 2018 survey by New Energy Update.

In response, OEMs are expanding supply chain, data analytics and repair capabilities to accommodate multiple turbine brands, company directors said.

Forecasting power

North American investment in wind O&M is set to soar in the coming years as fleet sizes grow and turbines age.

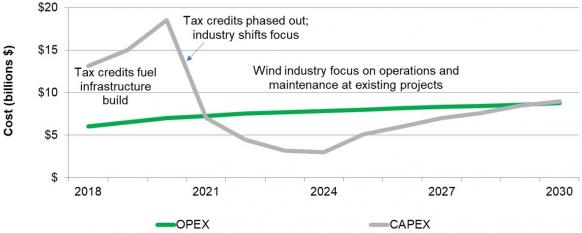

Annual investments in wind O&M in U.S. and Canada will rise from $5 billion-$6 billion in 2018 to $7.5 billion by 2021, eclipsing capex spending for the first time, IHS Markit said in a report.

Forecast North American wind opex vs capex

(Click image to enlarge)

Source: IHS Markit, September 2018.

Falling supply margins have spurred wind OEMs to increase investments in the O&M market, where margins have remained higher. OEMs are investing in spare parts infrastructure and digital technology to capture market share.

Last year, GE signed a 1.6 GW multi-brand turbine service contract with TerraForm Power which includes 400 MW of Vestas and Clipper Windpower turbines.

The full-scope contract include operations and maintenance (O&M) and the centralized operation of the Terraform fleet. GE said it would use its digital analytics solutions to optimize turbine performance, provide parts to non-GE assets and update existing site inventory and order mechanisms.

A key challenge for multi-brand service suppliers is the efficient transfer and processing of asset performance data, Marco Molina, Americas Services Sales Director at GE Renewable Energy, told New Energy Update.

For a mixed fleet of turbine brands, suppliers must understand turbine operation data and implement supply chain and service solutions. GE scales up the methodology used on its 62 GW global fleet of turbines to multi-brand arrangements, providing solutions that increase revenue and lower costs, Molina said.

Accurate forecasting is key to reducing lead times and inventory costs, he noted.

“The value we bring is our investment in and implementation of digital services across our fleet of wind turbines. Through our advanced data analytics, we are able to forecast and predict future failures and operational issues,” he said.

The wind industry can learn from analytics and automation techniques used in other sectors to improve supply chain efficiency.

Spare parts projects in the airline industry showed that effective implementation analytics and automation can dramatically cut down times and reduce spare parts inventories, Tushar Narsana, Managing Director, Supply Chain BPS at Accenture, told a conference last year.

A spare parts optimization project at a major airline supplier increased spares availability rates to over 90%, a level which should be attainable by the wind sector, Narsana said.

O&M expansion

In April, Siemens Gamesa signed its first full-scope multi-brand service contract for the 34 MW Lukaszow and 24 MW Modlikowice wind farms in western Poland. The wind farms comprise of 29 Vestas V90 wind turbines which have been operational since 2012.

Siemens Gamesa now maintains over 900 third-party turbines globally and expansion into new regions has required efficient local sourcing processes, Darnell Walker, CEO Services Americas at Siemens Gamesa Renewable Energy, told the Wind Operations Dallas 2019 conference in April.

"The thing that we felt that we have to really get honed in on is locally sourcing parts...[so that] we get those manufactured by local people in the region that we service," he said.

Top 10 onshore wind turbine suppliers in 2018

Source: BloombergNEF (BNEF).

For ISPs, strong supply relationships and in-depth turbine knowledge are key to optimizing supply chain efficiency, Billy Stevenson, UK Managing Director at Deutsche Windtechnik, an ISP, told New Energy Update.

"Having a high level of knowledge of each turbine type gives us a clear idea of the materials we’re likely to need during the life cycle. This in turn allows us to plan ahead by having the correct stock levels and understanding which components will have longer lead times," Stevenson said.

Active across Europe, Deutsche Windtechnik launched its O&M services in the U.S. in January 2018 and currently has 81 U.S. turbines under contract, for 186 MW of capacity.

"Despite the new size dimensions and distances, the U.S. wind market shows some parallels to the Spanish or English market," Deutsche Windtechnik said in its U.S. launch statement.

"For example, the requirements for occupational safety, processes and regulatory requirements are similar to the English service market. The intensity of the competition is more comparable to that in Spain due to a relatively concentrated operator structure," it said.

Repair centers

OEMs and ISPs are also expanding repair capabilities to reduce downtimes and widen O&M opportunities.

In Europe, Deutsche Windtechnik recycles and repairs mid to large size components out of a central repair center in northern Germany, Stevenson said.

Benefits of high quality repairs include cost savings, greater control over the supply chain, and wider recycling benefits, he said.

In the U.S, GE has invested in training and tooling for gearbox repairs at its Wind Energy Learning Center in Niskayuna, NY, Molina told the conference in April.

"We have a dedicated team- a repairs engineering team. They are partnered with the product line and they are constantly working to develop expanded capabilities in that space," he said.

By Beatrice Bedeschi