EDPR, Engie create joint offshore wind group; GE targets 3 GW of new US repowering projects by 2020

Our pick of the latest wind power news you need to know.

Related Articles

EDPR, Engie combine offshore wind resources, targeting 7 GW by 2025

Portugal's EDPR and France's Engie have created a joint company to develop offshore wind farms, targeting 5 to 7 GW of capacity in operation or under construction by 2025.

The joint venture (JV) will combine the development pipelines of EDPR and Engie, currently consisting of 1.5 GW under construction and 4.0 GW under development, making it one of the largest global offshore wind developers, the companies announced May 21.

The partners will primarily target projects in Europe, U.S. and selected regions in Asia and aim to have 10 GW of capacity under advanced development by 2025.

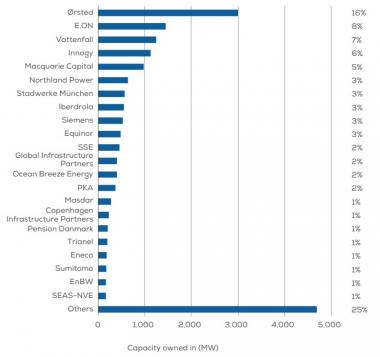

Owners' share of installed offshore capacity

(Click image to enlarge)

Source: WindEurope, February 2019

Technology advancements and installation learnings have sliced offshore wind power costs, producing subsidy-free prices in many European markets.

Developers are using economies of scale and series to optimize costs and are expanding into emerging offshore wind markets such as the US.

Last October, Denmark's Orsted, acquired 100% of U.S. group Deepwater Wind, raising its U.S. development pipeline to almost 9 GW. Orsted has since then divested 50% of offshore wind development assets in four East Coast states to New England utility Eversource, building on an existing joint venture with the group.

The world's leading offshore developer, Orsted plans to increase its installed capacity from 5.6 GW to 15 GW by 2025.

EDPR and Engie have already collaborated on the Dieppe Le Treport and Yeu Noirmoutier fixed offshore wind projects in France and the Moray East and Moray West projects in the UK. The companies are also partners in two floating offshore wind projects in France and Portugal and in the ongoing Dunkerque offshore wind tender in France.

In the U.S., EDPR recently formed a joint venture with oil major Shell to develop projects in Massachusetts and has partnered with U.S. groups to develop a 200 MW floating wind project in northern California.

GE to repower 3 GW of US wind capacity in 2019-2020

GE Renewable Energy expects to repower a further 3 GW of U.S. wind power capacity at 25 wind farms by the end of 2020, the company said May 21.

U.S. wind repowering activity has surged as operators capitalize on technology advances and tax credit windows to increase asset returns.

Since 2017, GE has repowered 4 GW of onshore wind capacity, at some 2,500 turbines. Customers have included NextEra, E.On, and MidAmerican Energy.

The repowering projects increased annual energy production (AEP) at the site's by around 20% on average, and increased availability by around 1.5%, GE said.

In 2017, MidAmerican Energy Company launched a $1 billion-project to repower seven wind farms in Iowa which were commissioned between 2004 and 2008.

The repowering projects were expected to increase annual output by up to 28% and provide over 20 years of revenues, a MidAmerican spokesman told New Energy Update.

GE secures 2 GW new turbine orders in January-May

GE signed 2 GW of new onshore wind turbine orders in North America in January-May, two thirds of the volume supplied by GE in the whole of 2018, the company announced May 21.

GE reclaimed the top spot for turbine manufacturers in the U.S. last year, installing 40% of wind turbines by capacity, according to the American Wind Energy Association (AWEA). Vestas installed 38% of capacity while Nordex USA held 11% of the market and Siemens Gamesa held 8%.

U.S. wind installations are forecast to surge in the next two years as developers race to meet production tax credit (PTC) deadlines.

Wood Mackenzie predicts 11.0 GW of capacity will be installed in the U.S. in 2019, rising to 12.9 GW in 2020.

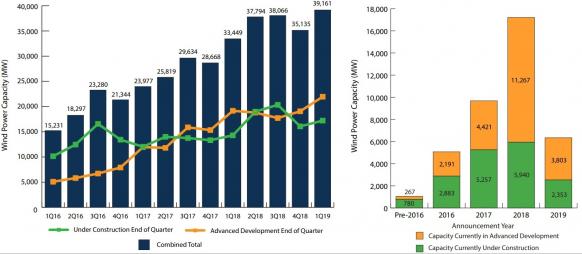

The U.S. wind development pipeline grew by 11% in the first quarter of 2019 to a record capacity of 39.2 GW, AWEA said its latest quarterly market report.

US wind capacity in advanced development

(Click image to enlarge)

Source: AWEA, April 2019.

The pipeline includes plants under construction and projects which have signed a long-term contract, placed turbine orders or are proceeding under utility ownership. Wind developers signed 2.7 GW of wind power purchase agreements (PPAs) in the first quarter. Utilities also announced plans to build and own a further 1.0 GW.

New Energy Update