US solar boom set to make PV with storage cost competitive by 2020

Falling costs and rising solar penetration could see the economics of PV plus storage projects overtake stand-alone PV in the coming years as the demand for solar 'peak shifting' and frequency response grows, a new study says.

Related Articles

By 2020, the business case for coupled PV with energy storage in California could be more favourable than stand-alone PV, according to a new report by the U.S. National Renewable Energy Laboratory (NREL).

California’s installed solar capacity rose from less than 1 GW in 2007 to over 17 GW by the end of 2016, increasing the demand for storage capacity to provide power outside daytime hours.

California hosts over 4 GW of energy storage capacity, most of which is pumped hydroelectric power. Directives from California's Public Utilities Commission (CPUC) require utilities to procure a total of 1.8 GW of energy storage capacity by 2024.

The coupling of energy storage can impact solar project economics in a number of ways.

Coupling PV and storage can increase the revenue by utilizing otherwise clipped energy, and reduce costs by sharing components. However, it can also decrease revenue by restricting storage operation during periods of high solar output due to shared inverter systems.

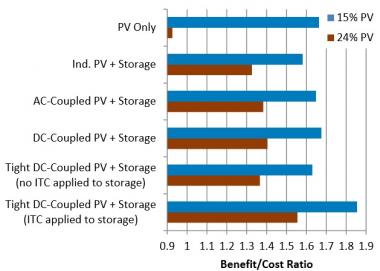

Under current market prices, stand-alone PV provides the highest benefit to cost ratio, but by 2020 it could be overtaken by PV coupled with storage as costs fall and PV penetration rises, NREL said in its report.

As the below chart shows, higher penetration levels will significantly favor PV with storage projects over stand-alone plants.

Forecast benefit vs cost of PV with storage

(Click image to enlarge)

Source: NREL (2017).

In the short to medium term, storage growth will depend on developers’ ability to transfer specific market requirements into bankable contracts, Leigh Zanone, Director of Plant Performance for US developers 8minutenergy Renewables, told New Energy Update.

“The key is to really get the value there and contract it in a beneficial way,” he said.

For large-scale PV projects, storage capacity can provide a number of potential services.

One key application which is expected to grow in the coming years is the shifting of generation to match demand profiles.

"That is an increased cost in the project which will mean an increased cost in the PPA [Power Purchase Agreement] rate. But that energy is much more valuable than traditional PV,” Zanone said.

California utilities such as Southern California Edison (SCE), Pacific Gas and Electric (PG&E) and San Diego Gas and Electric (SDG&E) have been key proponents of storage growth, but other states are also embracing new storage projects amid rising renewable energy capacity.

Arizona’s Tucson Electric Power (TEP) is seeking up to 100 MW of storage capacity. In May, the company announced it had agreed to offtake power from a new 100 MW solar array with 30 MW energy storage project being developed by NextEra.

“This new local system combines cost-effective energy production with cutting edge energy storage, helping us provide sustainable, reliable and affordable service to all of our customers for decades to come,” TEP said in a statement.

"Excluding the cost of storage, TEP will buy the system’s output for 20 years for less than three cents per kilowatt hour – less than half as much as it agreed to pay under similar contracts in recent years," the company said.

Developers are increasingly targeting frequency regulation as an application of energy storage coupling.

“Frequency regulation services are useful to the utility in a lot of different locations and generally smaller projects, 5, 10, 20 MW," Zanone said.

Frequency regulation revenues may be "wrapped up in the PPA" or provide an additional income stream for the developer, he said.

Earlier this year, TEP installed three battery storage systems for a combined capacity of 22 MW to provide grid-balancing support.

"These batteries can boost power output levels more quickly than conventional generating resources to maintain the required balance between energy demand and supply on our grid," TEP said.

Energy storage plants must be right sized to the specific market need, Colleen Lueken, Director of Market Analytics at AES Energy Storage, told New Energy Update.

Faster dispatch energy storage capacity allows solar operators to smooth out generation from solar arrays, without requiring longer storage periods, she said.

In other cases, developers may look to deploy solar plus storage as dispatchable baseload generation, requiring longer storage durations, Lueken said.

“The size of the energy storage and the solar array really depends on where in the stack you want to provide that power,” she said.

Grid support

Meanwhile, US federal and state authorities are preparing new market rules to improve grid reliability that are expected to further boost the value of PV plus storage.

While some state-level grid transmission operators have already introduced mechanisms which incentivise energy storage flexibility, state and market authorities face increasing pressure to improve grid reliability.

For example, in August, FERC called for market comment on planned frequency response requirements, seeking feedback on the cost of primary frequency response capabilities for small generating facilities and the role of electric storage resources.

Last month, Energy Secretary Rick Perry directed the FERC to accelerate implementation of Essential Reliability Services (ERS) mechanisms to compensate participants for grid reliability services. In a grid reliability report published in August, the DOE called for "a mix of market approaches, technology enhancements, and reliability rules or other regulatory rule changes," reiterating previous comments by the North American Electric Reliability Corporation (NERC).

The DOE’s grid reliability report also proposed new research and development (R&D) projects into "21st-century" grid reliability and resilience tools to enhance system reliability and resilience.

New technologies should be developed to support Bulk Power System (BPS) reliability in the context of rising renewable energy capacity, it said.

The DOE also recommended R&D projects focus on next-generation technologies such as storage technology and advanced power electronics, and sensors and controls, to increase the flexibility of grid operations.

Going forward, the increasing use of locational marginal pricing, where wholesale prices reflect the value of energy at specific points in the network, should further increase the value of PV plus storage.

As Charlie Gay, Director of the Department of Energy's Solar Energy Technologies Office, recently told New Energy Insider:

“The time value of electrons and location value of electrons enhances an increasingly sophisticated set of market opportunities.”

By David Appleyard