Giant Nevada solar project set for federal approval; Global PV installs forecast to rise 14%

Our pick of the latest solar news you need to know.

Related Articles

Nevada solar plus storage project clears environmental hurdle

The 690 MW Gemini solar plus storage project in Nevada looks set to receive federal approval after the U.S. Bureau of Land Management (BLM) issued a favorable Final Environmental Impact Statement (FEIS) December 30.

BLM will close its final comment period on January 27 and will issue a Record of Decision in the Federal Register by the end of Q1.

The giant Gemini project is being developed by Quinbrook Infrastructure Partners in collaboration with Arevia Power and will include a 380 MW AC battery storage system, providing 2,125 MWh of storage capacity, proposal documents show. The plant will be located 33 miles north east of Las Vegas, immediately south of the Moapa River Indian Reservation.

Nevada utility NV Energy has agreed to purchase the entire capacity from the project as part of 1.2 GW of new solar procurement set out under its latest Integrated Resource Plan. NV Energy will also purchase power from the Arrow Canyon and Southern Bighorn solar plus storage projects, currently being developed by EDF Renewables North America and 8minute Energy, respectively.

The Gemini project will result in "permanent disturbance" of 7,097 acres (2,873 hectares) within the 44,000-acre right-of-way (ROW) application area, BLM said in its FEIS.

The bureau favors a "hybrid" approach to land management, which would involve the mowing of vegetation across 65% of the solar array areas and the use of traditional method of vegetation removal and soil compacting for 35% of these areas.

This would allow desert tortoises to be moved back into the mowed areas when construction is complete, it said.

Iberdrola completes Europe's largest PV plant

Iberdrola has completed construction of its 500 MW Nunez de Balboa solar plant in south-west Spain, Europe's largest solar facility, within a year, the company announced December 27.

Located in Usagre in the region of Extremadura, the 290 million-euro ($322.6 million) plant is scheduled to start operations this quarter, Iberdrola said.

In July, Iberdrola secured 285 million euros for the project from the European Investment Bank (EIB) and Spain's ICO state bank.

Iberdrola has signed long-term power purchase agreements (PPAs) with Kutxabank, telecoms group Euskaltel and supermarket group Uvesco and could sign more, selling the remainder of the power to the wholesale market.

The Nunez de Balboa facility consists of 1.4 million solar panels, 115 inverters and two substations. Supply contracts were signed with 30 companies, many of them local, for a total value of 227 million euros.

Iberdrola plans to invest 8 billion euros in new Spanish renewable energy projects in 2018-2022. The company aims to install 3 GW of new renewable energy capacity by 2022, of which 2 GW will be in the Extremadura region.

Iberdrola plans to start construction of its 150 MW Campo Aranuelo complex in Extremadura in "early 2020," thanks to the region’s smooth administrative process, it said. The company's other PV projects in Extremadura include Francisco Pizarro (590 MW) in Torrecillas de la Tiesa, Ceclavin (328 MW) in Alcantara; Arenales (150 MW) in Caceres and Majada Alata and San Antonio (50 MW each) in Cedillo.

Solar installs set to rise by 14% in 2020 as growth spreads

Global annual solar installations are forecast to rise by 14% in 2020, to 142 GW, IHS Markit said in its 2020 Global Photovoltaic Demand Forecast, published January 7.

"Another year of double-digit global demand growth in 2020 is proof of the continued and exponential growth of solar PV installations in the last decade,” Edurne Zoco, director, Clean Technology & Renewables, IHS Markit, said in a statement.

Following steep cost reductions and technology advances, the 2020s will mark the "decade of emerging unsubsidized solar, diversification and expansion of solar installation demand across the globe, new corporate entry players and increasing competitiveness versus conventional energy sources,” Zoco said.

China will remain the world's largest solar market but lower subsidies and growth in other markets will reduce its share of global installations in the coming years, IHS Markit said.

"Installations outside of China, the world’s leading market, grew by as much as 53% in 2019 and are expected to continue growing by double digits in 2020," it said.

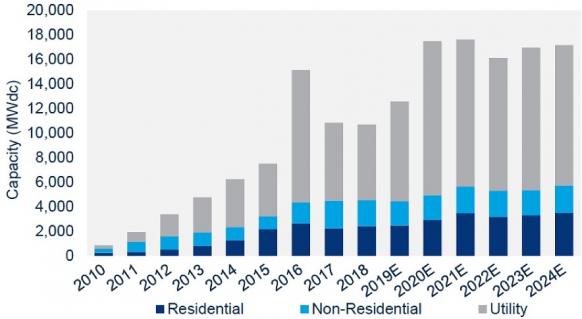

U.S. annual installations are forecast to rise by 20% in 2020, consolidating the U.S. as the world's second-largest market, IHS Markit said. California, Texas, Florida, North Carolina and New York will be key U.S. growth markets in the next five years, it said.

The U.S. Solar Energy Industry Association (SEIA) and Wood Mackenzie Power and Renewables predict even higher U.S. solar growth this year, driven by record levels of utility-scale installations.

US PV installation forecast

(Click image to enlarge)

Source: Wood Mackenzie Power and Renewables, SEIA, September 2019

Following a sharp rise in 2019, installations in Europe will rise by 5% in 2020 to 24 GW, IHS Markit said. Spain, Germany, Netherlands, France, Italy and Ukraine will account for 63% of demand, IHS Markit said.

New markets will emerge in Southeast Asia, Latin America and the Middle East, Zoco noted.

“Still, the major markets will continue to be critical for the development of the solar industry, especially as test beds of technological innovation, policy development and new business models,” he said.

Surging demand for bifacial modules and higher efficiency modules will drive growth in trackers in the coming years, IHS Markit said in an earlier report published in August 2018.

Some 150 GW of PV tracking systems are forecast to be deployed globally between 2019 and 2023 and the share of trackers in the ground-mounted solar market will double to around 40%, it said.

New Energy Update