Annual PV O&M costs set to double by 2024; US pulls tariff exemptions for bifacial panels

Our pick of the latest solar news you need to know.

Related Articles

Annual solar O&M costs set to hit $9 billion by 2024: WoodMac

Annual global solar operations and maintenance (O&M) costs will double from around $4.5 billion in 2019 to $9.4 billion in 2024, as installed PV capacity grows, Wood Mackenzie Power and Renewables said in a new report.

By 2024, inverter replacement costs alone will hit around $1.2 billion, representing around 13% of O&M costs, WoodMac said. Some 21 GW of inverter capacity will reach end of 10-year lifespans by the end of 2019 and this will hike to 176 GW by 2024, it said.

Annual solar installations will rise to 120 to 125 GW in the early 2020s, driven by growth in emerging markets, WoodMac said in an earlier report in July.

By 2022, some 19 countries are forecast to install between 1 and 5 GW of solar power per year, compared with just seven countries in 2018, WoodMac said. New growth markets include Saudi Arabia, France and Taiwan, it said.

Global solar markets by annual installations

(Click image to enlarge)

Source: Wood Mackenzie Power and Renewables, July 2019.

Global cumulative solar capacity is forecast to rise from around 500 GW in 2018, to 1.2 TW in 2024, WoodMac said.

By 2024, China, India and the U.S. will be the largest markets for O&M services, together hosting some 50% of global installed solar capacity, it said.

US removes import tariff exemptions for bifacial solar panels

The Trump administration has removed exemptions on import tariffs for bifacial panels in the latest bid to protect U.S.-made products.

In June, the U.S. Trade Representative (USTR) exempted bifacial solar panels from Section 201 import tariffs, accelerating activity in the emerging bifacial sector.

Following consultation with the U.S. Secretaries of Commerce and Energy, the USTR has decided to withdraw the exemptions for bifacial panels as they undermine the objectives of the Section 201 safeguards, it said in a notice published online. As of October 28, the exemptions will no longer apply, USTR said.

Demand for bifacial panels is soaring as operators seek higher yield to combat intense market competition. Bifacial plants can increase output by several percentage points, at relatively little extra cost.

Last month, Wood Mackenzie Power and Renewables forecast U.S. bifacial installations will hike from 500 MW in 2019 to over 2 GW in 2020, boosted by the tariff exemption. By 2024, U.S. bifacial installations could hit 7 GW per year, it said.

The removal of the exemptions could inflate prices for consumers, the Solar Energy Industry Association (SEIA) said in a statement.

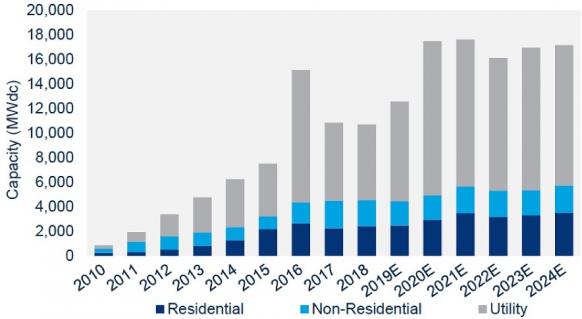

US PV installation forecast

(Click image to enlarge)

Source: Wood Mackenzie Power and Renewables, September 2019

"In its rush to judgement, USTR missed an opportunity to address the significant shortage of domestic solar panels and its decision will slow the growth of an American economic engine," the SEIA warned.

Key growth regions for bifacial solar plants include the Middle East, where desert-like terrain helps maximize reflected yield, South America, and Northern Europe, WoodMac said in its report.

By 2024, bifacial panels are forecast to represent 17% of the global solar market, it said.

European firms propose 2 GW PV factory to make green hydrogen

A group of major European manufacturers are proposing to build 2 GW/year of advanced solar manufacturing capacity in Europe to fuel the growing hydrogen economy, using funding support from the European Union (EU).

The project could create over 6,000 jobs and would be a welcome boost for Europe's PV manufacturing sector which has been severely impacted by cheap imports from Asia.

Germany's Meyer Burger, Hungary's Ecosolifer, Denmark's European Energy and Belgium's Hydrogenics want to build cutting-edge solar manufacturing and electrolysis facilities that could supply 10 GW of installed PV capacity and produce 800,000 tons of renewable hydrogen per year for industry, the companies announced October 9.

The "Silver Frog" project is estimated to cost 12 to 15 billion euros ($13.2-16.5 billion) and has been submitted to the European Union's Important Projects of Common European Interest (IPCEI) program. The EU has thus far received eight hydrogen proposals under the IPCEI program and plans to select the winning projects in 2020, industry group SolarPower Europe said in a statement.

Under the Silver Frog plan, Meyer Burger would supply the solar PV manufacturing line, Ecosolifer manufactures the modules focusing on heterojunction technology, European Energy acts as the energy developer and Hydrogenics supplies the water electrolysis technology. The project partners have identified Italy as a potential host of some of the solar power generation capacity. The balance between hydrogen production and consumption would be managed via "large-scale hydrogen storage solutions," the partners said in a presentation.

The hydrogen would be transported by gas pipelines to industries which are hard to decarbonize, such as the steel and chemicals sectors. Over a period of eight years, the new facilities could reduce annual CO2 emissions by around 8 million tonnes, the partners said.

Wind power groups are also looking to capitalize on the growing demand for hydrogen in transport and industry.

In March, Denmark's Orsted announced it is developing green hydrogen projects as part of its bid for the Holland Coast South 3&4 projects in the Netherlands. Orsted is the world's largest offshore wind developer by capacity and plans to increase its installed capacity from 5.6 GW to 15 GW by 2025.

Shell, Siemens and power grid operator TenneT also recently joined forces to propose new joint offshore wind power and hydrogen tenders in Germany.

New Energy Update