Wind insurer creates real-time yield cover as new risks emerge

Insurance group Munich RE has developed a yield cover product that uses wind asset data to create automated settlements, cutting costs and improving accuracy, company officials said.

Related Articles

Amid intense price competition, wind service providers are seeking new ways to increase efficiency and reduce risks.

Global prices for initial full-service contracts fell from an average $26,400/MW/yr in 2016 to $18,100/MW/yr in 2018 according to BNEF's Wind Operations and Maintenance Pricing Index. In some markets, contracts are trading at far lower levels, BNEF data shows.

Wind operators are combining remote monitoring and data analytics technologies with economies of scale to optimize plant maintenance and spare parts strategies.

Operators must mitigate a wide range of failure risks and insurance companies are now leveraging growing analytics capabilities to provide more bespoke risk products to the wind industry.

German insurance supplier Munich RE has developed a yield cover product which uses SCADA asset data to provide real-time settlements, company officials told the Wind O&M Europe conference on February 28.

The automated system slices processing times and is more accurate than traditional manual claims handling, Ronny Bendlin Spuer, project manager at Munich RE, told attendees.

“It is really just pure payment going back and forth,” Bendlin Spuer said.

“We are basically 'blockchain ready'," he said.

Critical components

Wind farm failures are usually caused by failing components or weather-related events.

Gearbox failure remains the most important driver of losses. Data gathered by Munich RE shows the average monthly probability of gearbox failure is 0.014%, compared with around 0.006% for blade damage or electrical failure.

Weather events also have a significant impact. Munich RE estimates monthly failure probability due to lightning at 0.010% and failure due to fire and storm damage at 0.004% and 0.002% respectively.

Weather risk assessments must take into account the increasing unpredictability of extreme weather events as well as longer term weather trends, Bendlin Spuer told the conference.

Wind farm data in Germany shows there is a clear long-term trend towards lower average annual wind speeds at some sites, he noted.

Emerging risks

To improve competitiveness, developers are installing larger, higher efficiency wind turbines and these bring about reliability challenges.

"We are cutting into the design margins, we are putting up equipment that is less costly but that could potentially have a longer term impact for those of us in operations," Ian MacRobbie, Vice President- Operations at Liberty Power, the renewable energy subsidiary of Algonquin Power & Utilities, said at the Wind O&M Canada 2018 conference in November.

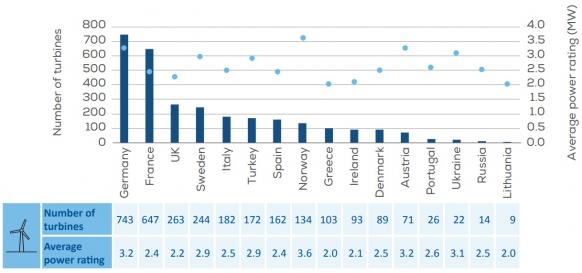

Number, size of onshore turbines installed in 2018

(Click image to enlarge)

Source: WindEurope, February 2019.

Larger towers and rotors will impact major components, experts told the Canada conference.

Increased stress on generators "requires more vigilance and more competence in our core skills," Ken Young, Chief Operating Officer of Apex Clean Energy, said.

New site conditions are also generally more demanding than those that in the past, offering lower wind levels-- requiring a larger rotor-- or higher levels of turbulence and wind shear, MacRobbie noted.

"We are starting to see the impact of that on the equipment," he said.

The offshore wind sector has seen the fastest increase in turbine capacities and this has led to a lack of operational data to effectively calculate insurance premiums, Tobias Aigner, Underwriter in Munich RE’s Green Tech Solutions, told the Europe conference on February 28.

"We will have to deal with 10 MW [offshore] turbines in three, four, five years from now, so this is actually a very tricky point for us, to calculate our premiums and to calculate possible losses in the future," Aigner said.

Following the removal of subsidized tariffs, wind farm owners must also manage financial risks associated with power purchase agreements (PPAs) and increasing exposure to wholesale markets.

Risk associated with PPA contracts include volume, shape and price risk and structures are becoming more complex as new types of offtakers enter the market.

Yield focus

In order to maximize revenue, wind farm owners are shifting from time-based availability guarantees to yield-based contracts.

Munich RE's new yield cover product collects SCADA data on production losses, actual availability and actual production data and produces an automated settlement payment based on a pre-set power price.

On top of speed and accuracy benefits, the system provides transparency for the operator and the insurance provider, allowing the operator to monitor insurance coverage for the asset, Aigner said.

"We can provide production data on a pretty much real-time basis and the client can actually see if [indicators are] below or above an insured threshold," he said.

A key advantage of this product is that it can be scaled at relatively low-cost, providing economies of scale for larger wind assets.

Life extensions

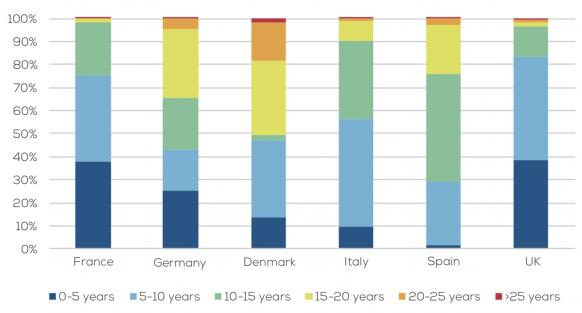

A growing number of Europe's wind turbines are reaching the end of their 20-year design lifespans, requiring operators to choose between life extension, full repowering, or decommissioning.

Wind turbine ages by country

(Click image to enlarge)

Source: WindEurope, August 2018.

Greater risks in the extended life period bring about new insurance calculations challenges.

Remaining life expectancy may not justify the replacement of a major component such as a gearbox and late life service agreements are often less comprehensive.

Thus far, a lack of operational data for turbines older than 20 years has limited insurance development in this age bracket, Aigner said.

In the coming years, growing data pools for late-life assets should provide new insurance opportunities.

More than 15 GW of German wind capacity is over 15 years old, WindEurope said in a recent report. In Spain, 6 GW is older than 15 years while in Denmark around 2.7 GW has reached this age.

New Energy Update