US wind will need storage to lure corporate buyers; Europe turbine life extensions could hit 4 GW/year

Our pick of the latest wind power news you need to know.

Related Articles

US wind industry will need storage to beat solar to corporate deals

The U.S. wind industry will need to implement new energy storage solutions in the coming years to fend off surging competition from solar and maximize its share of the corporate renewable energy market, Wood Mackenzie Power and Renewables said in a new report.

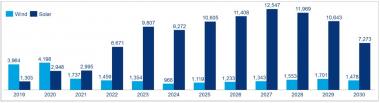

Falling solar costs, battery storage synergies, and favorable solar resource profiles will see U.S. corporate demand for solar overtake demand for wind in 2021, the research group said in its report, 'Analysis of commercial and industrial [C&I] wind energy demand in the U.S.'

Corporate demand for wind power is forecast to drop from 4.2 GW in 2020 to 1.7 GW in 2021 and remain between 1 GW and 1.7 GW per year throughout the 2020s, Wood Mackenzie said.

Over the same period, corporate demand for solar will soar to a high of 12.5 GW in 2027, under an "aggressive" demand scenario, it said.

Wind, solar corporate demand (aggressive forecast)

(Click image to enlarge)

Wood Mackenzie report 'Analysis of commercial and industrial [C&I] wind energy demand in the U.S,' August 2019.

"Power market dynamics and the continued reduction of solar power’s [levelized cost of energy] are suppressing wind energy demand in the long term," Wood Mackenzie said.

"Absent of a step change in turbine performance or cost reductions, it is increasingly obvious that for wind to compete amidst ever increasing renewables penetration, a long-term energy storage solution must be developed to cope with wind’s weekly and seasonal boom/bust cycle," it said.

The expiry of the investment tax credit (ITC) for solar power or a continuation of import tariffs on solar modules would help improve the competitiveness of wind against solar, the research group noted.

Europe life extension market estimated at 4 GW per year

Around 4 GW/year of European wind turbine capacity could be ripe for lifetime extensions in the period 2019-2028, according to a new report by Wood Mackenzie Power and Renewables.

Some 65 GW of European wind capacity will reach end of 20-year design life by 2028 and 42 GW could represent commercially viable life extension projects, the research group said. Around half of this identified capacity is located on small wind farms or distributed sites, where larger repowering projects are uneconomical, it said.

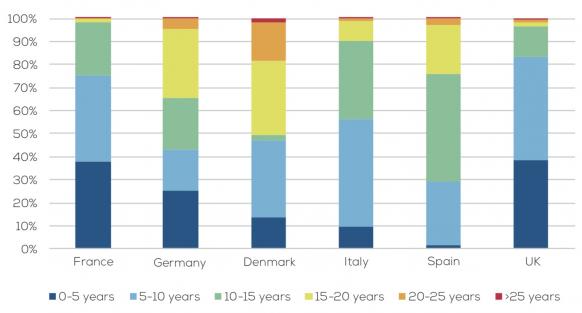

An increasing number of Europe's wind turbines are reaching end of design life, requiring operators to choose between life extension, full repowering, or decommissioning. The best option depends on asset age, maintenance costs and market conditions.

By the end of 2018, more than 15 GW of German wind capacity was over 15 years old, representing 35% of installed capacity, WindEurope said in a report. In Spain, 6 GW was older than 15 years (25%) while in Denmark around 2.7 GW, more than half of the wind fleet, had reached this age.

Wind turbine ages by country

(Click image to enlarge)

Source: WindEurope, August 2018.

New European Union legislation is set to accelerate demand for life extensions and full repowering, industry experts told New Energy Update earlier this year.

Renewable Energy Directive II and governance regulation, due to be effective from 2021, require member states to implement streamlined procedures for permitting and grid connection for repowering projects, and include repowering in national renewable energy targets.

"Currently, minimal regulatory support is offered for repowered and lifetime extension projects, forcing asset owners to operate in a merchant power market," Wood Mackenzie said in its report.

"Providing regulatory support for lifetime extension projects is one way to preserve existing capacity...The introduction of the post-2020 Renewable Energy Directive should provide clarity for asset owners to decide on whether to decommission, repower, or extend the lifetime of their onshore wind assets," it said.

Deutsche Bahn signs Germany's first corporate offshore wind deal

German train operator Deutsche Bahn has signed a deal with Innogy to buy power from its 295 MW Nordsee Ost wind farm, representing Germany's first corporate offshore wind power purchase agreement (PPA).

Operational since 2015, the Nordsee Ost wind farm consists of 48 wind turbines located 35 kilometres north of Heligoland.

Under the new contract, Deutsche Bahn will purchase 25 MW of capacity for a five-year period starting in 2024, the company said in a statement. Deutsche Bahn will pay a fixed price and RWE Supply & Trading will act as the contract and retail partner.

"This is a win-win deal for all parties involved...After the reduction of state subsidies, we are pleased to have agreed commercial terms for the supply of electricity from the first turbines at our wind farm and created scope for further investment in this way," Hans Bünting, COO of Renewables at Innogy, said in a statement.

Corporate wind deals are on the rise in Europe. Last December, Mercedes-Benz signed Germany's first corporate onshore wind PPA with Statkraft, a power generation and trading company.

Deutsche Bahn already purchases 57% of its electricity from renewable energy sources and plans to increase this to 100% by 2038.

“Over the next few years, we will consistently replace expiring contracts based on fossil-fuel generation with renewable energy," Torsten Schein, CEO of DB Energie, Deutsche Bahn's energy purchasing division, said.

"Before the end of September, we will start a further Europe-wide invitation to tender for the long-term purchase of green electricity,” Schein said.

New Energy Update