US to install 8 GW wind capacity to power past hydro; PPA signings soar

Our pick of the latest wind power news you need to know.

Related Articles

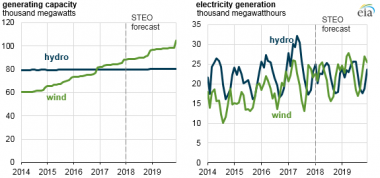

US annual wind output to surpass hydro for the first time

U.S. installed wind power capacity is expected to rise by 8.3 GW in 2018 and push annual wind generation above hydroelectric output for the first time, the Energy Information Administration (EIA) said January 24.

Installed wind capacity is expected to rise by a further 8.0 GW in 2019, EIA said.

Wind power is expected to provide 6.4% and 6.9% of U.S. Utility-scale generation in 2018 and 2019, respectively, up from 6.3% in 2017, it said.

"After a relatively wet year in 2017—when hydro provided 7.4% of total utility-scale generation—hydro generation is expected to be slightly lower at 6.5% of total utility-scale generation in 2018 and 6.6% in 2019," EIA said.

US wind, hydro capacity & output forecast

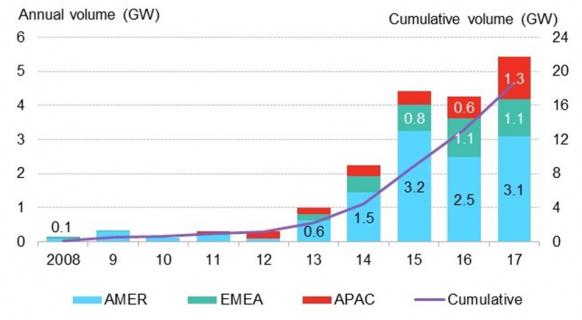

Corporate renewable PPAs rise 26% in 2017 to 5.4 GW

New corporate power purchase agreements (PPAs) for renewable energy rose by 26% in 2017 to 5.4 GW, driven by sustainability initiatives and falling renewable energy costs, Bloomberg New Energy Finance (BNEF) said January 22.

In the U.S., some 2.8 GW of PPAs were signed by corporations in 2017, up 19% year-on-year, BNEF said.

"The most notable of these deals was Apple’s 200MW PPA with NV Energy to purchase electricity from the Techren Solar project, the largest agreement ever signed in the U.S. between a corporation and a utility," it said.

In Europe, 1 GW of new corporate PPAs were signed, mainly in Netherlands, Norway and Sweden.

"In those countries, policy mechanisms allow developers to secure subsidies, while also giving corporations the ability to receive certificates to meet sustainability targets," BNEF noted.

Global corporate renewable PPA volumes

(Click image to enlarge)

The increase came despite regulatory uncertainty in the U.S. and Europe. Pending US import tariffs on solar panels and changes to European renewable energy certificates have impacted the economic calculation of PPAs.

However, BNEF expects renewable energy PPA volumes to grow further in 2018.

"Commitments on the part of companies to use renewable electricity, including those made via the RE100 campaign, remain the most promising source of demand," BNEF said.

Under the RE100 initiative, companies pledge to source 100% of their electricity from renewables by a future date. Some 35 new companies signed up to the RE100 initiative in 2017, raising the total number to 119.

Progressive offshore wind rules could cut power system costs by 7%

A rapid expansion of UK offshore wind capacity through the use of zero-subsidy contracts for difference (CfDs) and "revenue-stack" regulation could reduce UK power system costs by 7%, independent analyst group Aurora Energy Research said in a report published January 18.

The implementation of zero subsidy CfDs and rules which allow offshore wind operators to stack revenues could increase UK offshore capacity from 6 GW in 2017 to 30 GW by the 2030s, the report said.

The system integration costs of offshore wind would be limited to 6 to 7 pounds/MWh ($8.5-9.9/MWh) in the 2030s, Aurora said.

Reduced system costs would equate to annual savings to consumers of 1 to 2 billion pounds, it said.

Plummeting UK offshore wind prices show developers are combining technology advancements and installation experience with innovative grid build modelling.

Following rapid price falls, offshore wind companies must tackle growing merchant risks to ensure future projects remain competitive and supply facilities remain profitable, leading industry executives said at the Offshore Wind Europe 2017 conference in November.

Zero-subsidy CFD’s and new revenue stack regulation would provide a "viable long-term route to market for offshore wind" and help to secure further investment and supply chain opportunities, Aurora said in its report.

New Energy Update