UK utility’s wind storage surge shows risks of going green

ScottishPower’s storage buildout plan will provide grid service and peak shifting benefits but the group’s switch to a 100% wind portfolio also raises wholesale trading challenges, market experts told New Energy Update.

Related Articles

Last month, UK utility ScottishPower announced it would build a 50 MW lithium-ion battery, the U.K.'s largest, to support its 539 MW Whitelee wind farm in Scotland.

Due online by the end of 2020, the Whitelee battery facility is reportedly the first of at least six energy storage projects planned by ScottishPower over the next 18 months. A subsidiary of Spain’s Iberdrola, ScottishPower plans to invest 2 billion pounds ($2.5 billion) in clean energy projects in the UK in 2019 and a total of 6 billion pounds by 2019, the company said in March.

ScottishPower recently became the first UK power utility to generate 100% of its electricity from wind energy after selling its remaining 2.6 GW gas and hydroelectric power plant fleet to Drax for 702 million pounds.

Falling costs and rising carbon reduction targets are spurring utilities to switch to wind and solar generation. The UK plans to phase out coal-fired power generation by 2025, removing from the grid a technology which generated a quarter of the U.K.’s power in 2015. Last month, the UK passed laws to achieve net zero carbon emissions by 2050.

ScottishPower currently has 2.7 GW of wind power capacity operating or under construction in the UK and a 3 GW development pipeline consisting almost entirely of offshore wind projects. The group will look to secure further UK offshore wind projects when the government holds its next lease rounds and also plans to develop a further 1 GW pipeline of onshore wind projects by 2025.

The rapid battery construction planned by ScottishPower highlights the challenges of switching to renewable generation portfolios, experts told New Energy Update.

In the coming years, the growing penetration of wind and solar and the removal of subsidies will require utilities to implement new hedging tactics for wholesale power markets, they said.

Storage surge

Falling battery costs, rising renewable energy capacity and new market regulations are driving up utility demand for energy storage.

The levelized cost of electricity (LCOE) of lithium-ion batteries fell by 35% between the first half of 2018 and March 2019, to $187/MWh, according to figures from BloombergNEF.

Coupling of batteries with wind or PV assets helps to further reduce costs through balance of system and grid connection savings. A power tender held by Colorado's Xcel Energy in early 2018 yielded a median price for wind projects with battery storage of $21/MWh, only slightly higher than the median price for stand-alone wind projects of $18.1/MWh.

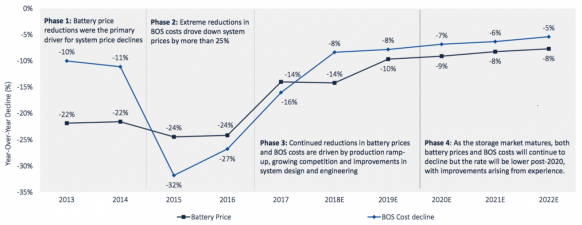

Forecast battery, storage system costs

(Click image to enlarge)

Source: Wood Mackenzie Power and Renewables (GTM Research), February 2018.

There is currently around 700 MW of large-scale battery storage capacity installed in the UK and a further 500 MW of large-scale capacity could come online by the end of the year, data from Solar Media Market Research shows.

UK storage demand has been boosted by market measures implemented by UK power authorities to incentivize energy storage for grid management. Key applications to date include frequency regulation, peak charge avoidance, distribution grid support, renewable capacity firming and capacity markets, the U.K.'s Department for Business, Energy and Industrial Strategy said in a document in November 2018.

ScottishPower's Whitelee storage facility will offer short duration charging and dispatch, enabling it to provide services such as reactive power and frequency response, as well as wind peak shifting to supply higher demand periods.

The battery will be able to fully charge in less than 30 minutes and can be fully discharged or used in bursts, ScottishPower said.

The battery will be built on vacant land within the Ardochrig substation compound on the edge of the Whitelee wind farm site in order to optimize existing infrastructure and minimize grid connection costs, it said.

As battery storage costs continue to fall, larger storage units will be deployed across a wider number of market applications, offering longer storage and dispatch periods, Shane Slater, director at U.K. consultancy Element Energy told New Energy Update.

The record size of the Whitelee battery is “giving confidence that more battery deployment can happen, and costs will come down,” he said.

Day trader

Shifting entirely to wind power generation poses a number of market challenges and battery storage can only mitigate some of the risks.

The exposure of wind assets to wholesale power markets will depend on whether the projects have secured a contract for difference (CFD) with the UK government, or are based on UK utility renewable obligation commitments or on a merchant market basis, Mike Mahoney, head of wholesale and modelling at U.K. consultancy Cornwall Insight, told New Energy Update.

There is currently around 2.8 GW of wind capacity operating under the CFD mechanism, which guarantees revenues according to a pre-agreed strike price. Most of this capacity is offshore wind as onshore wind and solar have been excluded from the CFD auction process since 2015.

In contrast, there is over 18.5 GW combined onshore and offshore wind capacity operating under the UK's renewable obligation scheme, which provides revenue certificates to generators on top of wholesale market revenues.

While wind assets backed by CFDs will return a consistent revenue for all output, the exposure of most of the UK’s operational wind capacity will depend on the structure of the power purchase agreements (PPAs) in place, Mahoney noted.

UK average day-ahead baseload power prices

(Click image to enlarge)

Source: Ofgem, July 2019.

Scottish Power’s switch to 100% wind will mean its generation profile will not match its customers' demand. A combination of onshore and offshore wind capacity helps mitigate supply risks, but ScottishPower will still be exposed to windless days and cold snaps that hike demand. Current battery storage technology typically provides up to four hours of dispatch capability.

“As a result, they will be active in the day-ahead and intra-day markets to cover the differences and avoid imbalance, potentially to a greater extent than other suppliers,” Mahoney said.

Growing exposure to wholesale power prices also places increasing importance on wind turbine maintenance.

Turbine advancements and growing analytics and forecasting capabilities allow operators to perform predictive and preventative maintenance strategies in order to reduce downtimes and maximize market revenues.

Going forward, growing wind and solar penetration and increasing reliance on capacity market mechanisms will create further price volatility in short-term trading windows, Mahoney warned.

"With a greater proportion of intermittent generation on the system and flexible back-up capacity costs it is likely that we will see increasing price volatility at the day-ahead/intra-day stage," he said.

By Beatrice Bedeschi