Plummeting prices test offshore developers amid fragile supply chain

A sharp drop in offshore wind prices and global expansion plans have increased the pressure on developers to control costs and meet project deadlines in a rapidly-consolidating supply market, industry leaders told the Offshore & Floating Wind Europe 2019 conference.

Related Articles

Technology advancements and European deployment learnings have sliced offshore wind costs and laid the foundations for global growth.

In September, the UK government awarded 5.5 GW of new offshore wind projects at contract for difference (CFD) strike prices of between 39.65 and 41.61 pounds/MWh ($51.3/MWh-$53.9/MWh), around 30% lower than prices awarded in 2017.

"For the first time renewables are expected to come online below market prices and without additional subsidy on bills," the government said in a statement.

Elsewhere in Europe, project tenders have produced zero-subsidy bids, exposing developers to wholesale market risks.

Such progress has come at a price. Margins have been crushed and industry participants are now questioning whether prices have gone too low.

Offshore wind will be key to decarbonizing our energy supply and prices have fallen so low they are threatening the sustainability of the industry, Eddie O’Connor, Executive Chairman of developer Mainstream Renewable Power, told the conference in London on November 11.

"The prices have gone too low...the industry right now is on its knees- the whole of the supply industry," O'Connor said.

Developers are expanding into new markets in U.S. and Asia, ramping up pressure on European performance.

Global investors will want to know developers can provide the returns built into the latest projects, Dominic Szanto, Director and Head of Offshore Wind at JLL advisory group, told the conference.

"Those last few projects for the last three to four years absolutely do need to come in on time and on budget," Szanto said.

Industry effort

The drive for lower prices has prompted developers to work closely with the supply chain and EPC partners to reduce costs.

"It is a tough business," Catrin Jung, Head of Market Development at Vattenfall, a leading offshore developer, said. Vattenfall will build the 350 MW Hollandse Kust I and II and 760 MW Hollandse Kust 3 and 4 offshore wind farms in the Netherlands at unsubsidized prices.

"With the bids we have handed in we are working with suppliers to make it a situation where we can create value together," Jung said.

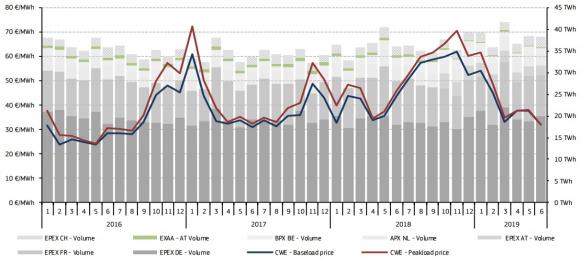

Average day-ahead power prices in Central Western Europe (CWE)

(Click image to enlarge)

Source: Source: European Commission's quarterly electricity market report (Q2 2019).

Germany's Innogy was awarded a CFD at 39.65 pounds/MWh for its 1.4 GW Sofia project at Dogger bank in the UK North Sea. Located some 195 km off the UK coast, the facility is due to generate first power in 2024-25 and be fully commissioned by 2026.

"We genuinely believe we will be able to deliver that project for that price," Richard Sandford, Director of Offshore Investment & Asset Management, Innogy Renewables, told the conference.

"We've been working on that project for a long time. It's been massively, cleverly engineered and optimized-- we've been working with the supply chain, the financing communities," he said.

Innogy has a year to achieve the milestone delivery requirement (MR) for Sofia, which requires a final investment decision or spending of 10% of development costs, Sandford said.

"If everything goes as we assume and we plan it will go, then [the project] is deliverable," he said.

Aggressive pricing strategies offer little margin for error during construction, warned Pieter Marinus, General Counsel & Investment Relations Director at Belgian developer Parkwind.

"People sometimes forget we are working with large infrastructure projects. If something goes wrong, usually the hit is significant," Marinus said.

Innovation payoff

Offshore wind installations are set to surge in the late 2020s and supply chain efficiencies implemented now will be rewarded as activity grows, Jung told attendees.

"We will ramp up quite drastically... I'm quite sure that whatever money and knowledge suppliers invest now into cost reductions, [through] cooperation, will actually pay out," Jung said.

Growing turbine capacities have been a key driver of cost reductions and this is set to continue in the 2020s. Denmark's Orsted will become the first developer to use 12 MW turbines after selecting to use GE's Haliade-X turbines for its 120 MW skipjack project in Maryland, U.S. The project is due online in 2022.

Offshore wind costs could fall by a further 16% by 2030 to $2.4 million/MW, including a transmission cost segment of $0.8 million/MW, Tom Harries, Senior Associate, Offshore Wind at BloombergNEF (BNEF), said.

Larger, higher efficiency turbines will lower component costs and boost installation efficiency, but savings will be curbed somewhat as sites creep further offshore, Harries said.

Margin pressures

Intense price competition has crushed margins and spurred consolidation in the turbine supply market.

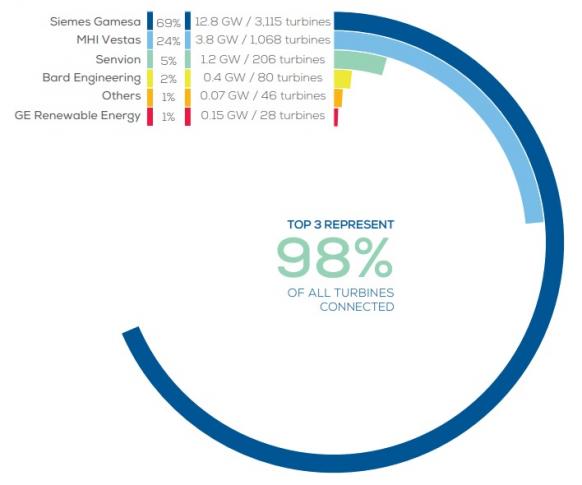

In Europe, offshore turbine supply has been dominated by Siemens Gamesa and MHI Vestas. Senvion, Europe's third-largest offshore turbine supplier by capacity, entered voluntary insolvency in April following unsuccessful refinancing talks with lenders.

Turbine supplier share of offshore wind market (end 2018)

(Click image to enlarge)

Source: WindEurope report 'Annual Offshore Statistics 2018'

Supplier margins are lower than in other industries such as oil and gas, threatening investor confidence, O'Connor said.

"You only get financing if you are profitable...and if no finance, no build," he noted.

The current rate of market consolidation could indicate we are reaching the bottom of prices, if we want to establish a sustainable supply chain, Morten Melin, Executive Vice President Construction of Northland Power, a Canadian developer, said.

"In many of the supply chain parts, we see bankruptcies-- not one, not two but multiple bankruptcies right now," Melin said.

"There is an existential risk out there right now until we get some price back into this market," O'Connor said.

"Until we get paid for the products we sell at a decent price, which includes some charge for pollution, this existential risk will remain," he said.

Higher powers

Going forward, Europe must implement structural market changes to decarbonize Europe's energy supply, developers told the conference.

Europe's wholesale power markets are based on marginal cost of dispatch and as renewables penetration rises, these pricing structures will need to evolve, they said.

European Union (EU) members must also cooperate to build out regional offshore transmission infrastructure, participants said.

"The infrastructure part is a problem," Jung warned.

"Every member state is still doing their own optimization...You need a different approach to how you connect the different offshore wind parks and how you optimize across," she said.

A European offshore "supergrid" could be built across Europe's northern sea regions, allowing efficient power distribution to load centers and smoothing out differences in wind resources, O'Connor told attendees.

"Europe needs to think of itself as one entity to supply," O'Connor said.

"I don't think we can meet our targets in Europe without getting the supergrid going," he said.

New Energy Update