Norway seeks major role in floating wind supply chain

Norway is hosting first-of-a-kind floating wind projects and opening up new sea areas for technology development, aiming to turn oil and gas know-how into renewable trade exports.

Related Articles

Two recent announcements by Norway's government highlight the momentum gathering behind Norwegian floating wind development.

In August, Norwegian state fund Enova agreed to fund NOK2.3 billion ($252 million) towards Equinor's NOK5 billion Hywind Tampen floating wind project. The 88 MW project would supply power to the Gullfaks and Snorre oil and gas platforms on the Norwegian Continental Shelf (NCS).

A month earlier, the Norwegian government launched public consultations into opening three sea areas for offshore wind development. The sea areas include Utsira Nord, a 1,010 sq km area located 22 km off the coast of Haugesund which has an average water depth of 267 m, too deep for fixed-bottom projects. Utsira Nord could host up to 1.5 GW of demonstration and commercial floating wind projects based on land grid capacity, official documents show.

Norway currently has little need for large-scale domestic offshore wind capacity as it sources 98% of its electricity from hydropower. More likely, Utsira Nord will become a development hub for demonstration floating wind projects, paving the way for commercial trade exports.

The Norwegian government is seeking to create an export-driven floating wind industry, building on the country's experience in the oil and gas industry, shipping and renewable energy.

"For us, this funding is about bringing floating offshore wind one step closer to commercialization," Nils Kristian Nakstad, CEO of Enova, said.

The positive impact on climate change and Norwegian business and industry would be felt for a "very long time to come," Nakstad said.

Deep history

Floating wind activity is surging as developers look to tap into an estimated 4 TW of global offshore wind capacity found in water depths of over 60 meters.

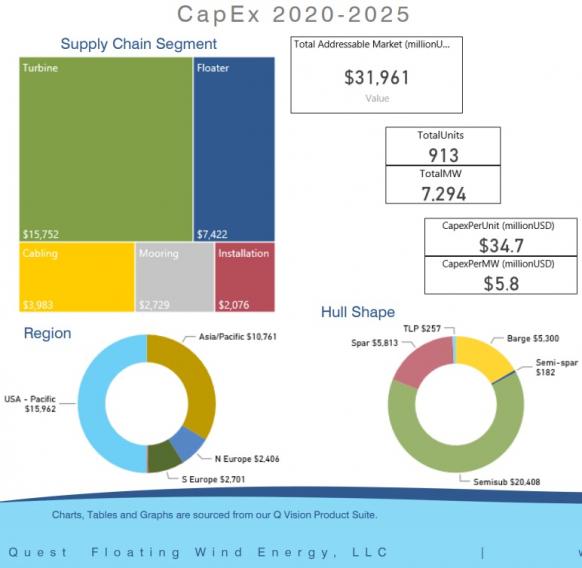

Forecast floating wind capex by technology area

(Projects under development, planned & possible)

(Click image to enlarge)

Source: Quest Floating Wind Energy: ‘Global Floating Wind Energy Market Forecast (2019-2031).’

A major global oil and gas producer, Norway has decades of offshore platform, shipping and shipyard expertise it can apply to offshore wind projects.

Equinor (formerly Statoil) operates 40 offshore platforms on the Norwegian continental shelf, representing around 70% of the nation's oil and gas production.

Norway is one of few European countries that already have ports suitable for the commercial development and operation of floating wind farms, according to a 2018 study commissioned for the U.K.'s Carbon Trust.

Quayside construction of large-scale floating wind farms requires ports to have large areas for component set down and production lines, and an area for wet storage of assembled units, the study by LOC Renewables, WavEC and Cathie Associates, noted.

In addition to Utsira Nord, Norway also proposes to open up the Sandskallen – Soroya Nord Sea area which lies north-west of Hammerfest in the far north. This area would be suitable for both floating and fixed-bottom wind development.

"It is important to open one area for bottom-fixed wind power near the coast. This provides opportunity for the ocean industries in the north," Kjell-Borge Freiberg, Minister for Petroleum and Energy, said.

The government is also consulting on opening up the Sorlige Nordsjo II area near Danish waters, which could be used to export power to continental Europe, particularly from fixed-bottom plants. The consultation for all three proposed areas closes on November 1 and the government has earmarked 12 other areas for potential development at a later date.

International projects

Denmark’s Stiesdal Offshore Technologies (SOT) has already chosen Norway as the site for its first large-scale TetraSpar pilot floating wind plant.

In February, oil major Shell and power group Innogy agreed to take 66% and 33% stakes in the 18 million-euro pilot project, which will install a 3.6 MW Siemens Gamesa direct drive turbine in water depths of 200 m at the Marine Energy Test Centre (Metcentre) 10km offshore, near the city of Stavanger.

Founded in 2009, the Metcentre provides concessions, infrastructure and services to test offshore wind technologies.

Denmark's Welcon started manufacturing the TetraSpar structure components earlier this year and these will be assembled at the port of Grenaa, Denmark. Following launch of the structure, the turbine will be mounted on the foundation at the quayside using a land-based crane. The turbine will then be towed to the site, moored to the seabed with three anchor lines and connected to the grid by summer 2020.

Oil power

If agreed, Equinor's Hywind Tampen project would be the first floating wind farm directly connected to offshore oil and gas platforms. The 88 MW facility would supply 35% of the power needs of the five platforms situated on the Snorre A and B and Gullfaks A, B and C oil and gas licences.

Hywind Tampen project follows Equinor's 30 MW Hywind Scotland floating wind project in the UK, the world's first commercial-scale floating wind farm.

Operational since October 2017, Hywind Scotland has collected valuable data on the operation of five 6 MW Siemens direct drive turbines in water depths of 95 to 120 meters.

Hywind Tampen will help to reduce the costs of future floating offshore wind farms, offering "new industrial opportunities for Norway, the licences and Norwegian supplier industry in a growing global offshore wind market,” Olav-Bernt Haga, project director for Hywind Tampen, said in August.

The seven partners in the Snorre and Gullfaks licences are expected to make a final investment decision on Hywind Tampen this fall. Pending permitting approvals, the project could be operational by 2022, Enova said.

By Neil Ford