GE’s giant turbine sparks offshore supply chain build-out

GE blade subsidiary LM wind power has developed new handling and manufacturing tools to support the record-breaking 12 MW design and a new port-side factory will come online later this year, Alexis Crama, VP Offshore at LM Wind Power told New Energy Update.

Related Articles

Last month, GE Renewable Energy launched the world's largest offshore wind turbine, the 12 MW Haliade-X. GE will invest $400 million in the design over the next three-to-five years and aims to install the first demonstration turbine in Q2 2019 and start commercial shipments from 2021.

Larger, higher efficiency turbines and growing installation experience have dramatically reduced offshore wind costs, producing record-low tender prices across Europe. Recent tenders in Germany and Netherlands were won by zero-subsidy bids.

The Haliade X is a significant advancement in offshore turbine capacity. Last year, Denmark’s Orsted installed the world's first 8 MW turbines in the UK and the average capacity of newly-installed turbines was 5.9 GW.

The Haliade-X is 250 metres tall and has a 220-metre rotor, 34% longer than that on MHI Vestas’ V164-8.0 MW model. GE’s turbine will achieve a capacity factor of 63% which is five to seven percentage points higher than the current industry benchmark, according to the company.

"Every point of capacity factor is worth $7 million per 100 MW for our customers," Vincent Schellings, GE’s chief offshore wind engineer, said in a recent company report.

Larger turbine capacities also significantly reduce operations and maintenance (O&M) costs by cutting the cost of vessels, labor and spare parts per MW installed. BNEF has estimated growing turbine capacities directly impact as much as 60% of O&M costs.

The launch of the Haliade-X shows GE intends to gain a larger foothold in the offshore wind market, where it has fallen behind other leading suppliers. The announcement comes ahead of sharp growth expectations in U.S. offshore wind capacity alongside steady growth in European markets.

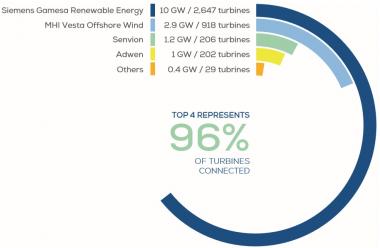

Europe offshore turbine market share

(Cumulative, end 2017)

(Click image to enlarge)

Source: WindEurope (February 2018).

All the main leading turbine suppliers are expected to respond with larger models in the coming years. Continuing advances in turbine capacities are spurring a wide range of supply chain and vessel solutions, but further innovations are required to ensure growing dimensions equate to greater project efficiency.

Suppliers respond

The trend towards much larger turbine capacities brings about significant design, manufacturing, logistics and installation challenges. Scaling-up blades, for example, results in higher loads and longer panel spans which require adaptations to material properties and buckling design. Manufacturing requirements include bonding paste adaptations for larger blades and modifications to component handling and tooling.

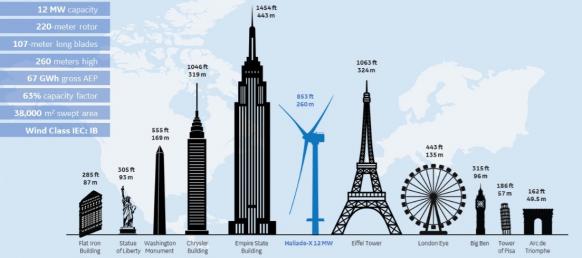

Dimensions of the 12 MW turbine

(Click image to enlarge)

Source: GE

An EU-funded study published in October showed major component suppliers and research and government (R&D) teams are responding to the challenges of growing turbine capacities.

The EU’s INWIND study found that the “industrialisation” of components and availability of bespoke installation and maintenance vessels for 10 MW turbines is "progressing in parallel with turbine development."

GE blade subsidiary LM Wind Power has developed new equipment and processes and is building a new factory to manufacture the giant 107m blades used in the Haliade X design, Alexis Crama, VP Offshore at LM Wind Power told New Energy Update.

“The sheer scale of this product pushes the boundaries of our facilities...The huge moulds needed mean that core processes such as glass lay-up or preparing for infusion require special equipment to allow our people to reach far enough into the work area and ergonomics is a whole chapter in its own right,” he said.

Cost reduction pathways are being integrated at the design, manufacturing and installation phases.

“Every single layer of composite material is scrutinized to identify safety and weight optimizations,” Crama said.

To ensure process repeatability and consistency in product quality, LM Windpower is using automated processes to collect data on material and adjust activities accordingly.

Later this year, the company will open its first dedicated offshore wind factory in the port of Cherbourg, France, to remove the need for road transportation, Crama said.

“Logistics is obviously a challenge so minimizing handling and moving for large components is key,” he said.

Structure costs

The scaling up of turbine capacity requires designers and manufacturers to carefully balance efficiency gains against capital cost increases.

In particular, the increase in the cost of structural supports becomes more important as dimensions grow.

"It’s kind of unfortunate that as you scale the rotor size, the turbine costs will go up quicker than the incremental yields you get from the larger rotor,” Schellings said in the GE report.

To establish the capacity of the Haliade-X, the GE team selected a specific rotor dimension and used data modelling to calculate the optimal magnitude of the generator and associated tower costs.

Efficiencies established during the demonstration stage will prove key to controlling costs for commercial deployment.

“All the work from the design, to the material selection, manufacturing, first transportation, culminates with the first installation of the prototype,” explained Crama.

“Every step of the way to that milestone is carefully planned and executed, balancing investment versus gain levels,” he said

Towards 20 MW

Orsted has predicted turbines of capacity 13 to 15 MW will be on the market by 2024 as operators continue to demand greater cost efficiency. For capacities to rise much higher than these levels, supply chain gaps must be filled.

The EU's INWIND study found that the offshore wind supply chain is not currently able to produce a number of main components for 20 MW units. Supply chain gaps include:

- Pitch bearing

- Direct drive generator or advanced gearbox technology allowing an economic design at required scale

- Blades at required length and blade testing facilities

- Availability of economic installation and maintenance vessels

Even if these solutions are provided, it is not a certainty that a 20 MW turbine will provide a lower cost of energy than a 10 MW or 15 MW turbine, the study noted. Cost-efficient scaling of turbines to 20 MW would require “innovations in the component and system design,” it said.

Going forward, much higher turbine capacities may require significant upgrading of manufacturing processes and offshore supply networks including dedicated port side facilities, Crama said.

“It will be a balance to ensure the expansion of turbines happens in a cost-efficient way,” he said. “But the current platforms can take us well into the future.”

By Kerry Chamberlain