GE's 40-year turbine life certificate could cut costs by 20%

GE Renewable Energy's new 40-year turbine life certificate will increase investor confidence in longer revenue models but deployment will depend on capex trade-offs and outlooks for turbine advancements, industry experts told New Energy Update.

Related Articles

In May, Germany’s TUV issued GE Renewable Energy the world's first 40-year wind turbine Design Evaluation Conformity Statement (DECS), double the length of standard turbine certification lifespans.

Issued for GE's latest 2.7 MW turbine, GE plans to acquire similar length certification for other models.

The move comes as wind farm operators seek longer lifespans to maximize revenues in increasingly-competitive power markets. Falling capex costs have squeezed suppliers’ margins and raised the importance of operational efficiency.

GE’s 40-year life certificate could reduce the levelized cost of energy (LCOE) of wind farms by up to 20%, Paul Judge, General Manager, 2 MW Platform at GE, told New Energy Update.

The certificate also helps to de-risk life extension investments for operational turbines and could be used to boost revenues from turbines that are under-used due to variable site conditions, Judge said.

“Looking at longer lives allows customers to transform this [under-used] margin into economic opportunity”, he said.

Longer turbine certifications will support longer revenue models but deployment may depend on site-optimization decisions and repowering strategies, industry experts told New Energy Update.

Load test

The 40-year DECS covers products released from 2019 and is valid in markets that accept International Electrotechnical Commission (IEC) standards.

To issue its approval, TUV Nord assessed the design's ability to handle additional loads expected from extended service life, as well as ageing and wear and potential faults from longer operations.

“The durability, fault risks and ageing are handled via design optimization, analysis or additional inspections and maintenance tasks,” Judge said.

Documentation provided by GE included turbine load calculations and verification of component design, for the rotor blade, mechanical components and structures, tower and internals parts. TUV also evaluated the safety system and manuals, the electrical system and manufacturing processes.

The load spectrum was particularly important in securing the 40-year DECS, Mike Woebbeking, Executive Vice President of Renewables at TUV Nord, told New Energy Update.

“Since the load spectrum describes the fatigue loading within the turbine lifetime, it is significantly increased compared to a lifetime of 20 years. This needs to be considered in the load and component evaluation,” he said.

In the increasingly-competitive operations and maintenance (O&M) market, turbine suppliers have sought to lock in long-term service contracts of 25 years or longer. It remains to be seen whether GE will offer much longer full service packages for the 40-year certified product.

Longer revenues

Longer certified lifetimes should boost investor confidence in longer financial models and prompt developers to seek longer leases, Keith Burns, Commercial Director at wind developer Natural Power, said.

"It is likely that developers will be interested in negotiating as long as possible leases with landowners in the first place, or options for extensions,” he said.

Most turbines are typically certified for 20 years but some have already gained 25-year or 30-year approvals.

Vestas and Enercon offer 25-year certificates on some of their models while Vestas offers up to 30 years for non-turbulent sites with low wind speeds where Class II turbines are deployed.

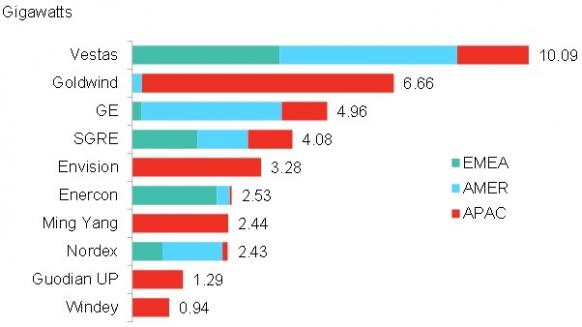

Top 10 onshore wind turbine suppliers in 2018

(Click image to enlarge)

Source: BloombergNEF

Vestas has also recently moved towards a more site-specific approach to design.

Last month, Vestas secured its first order for the Enventus modular turbine platform, for TuuliWatti's 151 MW Simo Sarvisuo wind park in Finland. Launched in January, the Enventus platform allows Vestas to select components that optimize specific site conditions.

The contract includes the supply of 5.6 MW turbines and a 30-year active output management service agreement.

Vestas worked with TuuliWatti to optimize the design for the site. Improvements included a tower solution designed to raise the largest rotor in the onshore market to a hub height of 166 meters, "enabling the turbines to capture new wind resources at higher and more consistent wind speeds," Vestas said in a statement.

"A site-specific solution, for example a site specific tower, can add or reduce capex to a project," Burns noted.

Designing for a longer life cycle would likely result in a heavier and higher-capex tower and the value of these improvements must be assessed against LCOE, he said.

Future upgrades

A longer lifespan product is an interesting strategy for turbine suppliers, given they also gain revenues from selling new units for repowering projects.

Even with longer certified lifespans, the actual operational lifespan of new turbines will depend somewhat on future advances in turbine technology.

In recent years, rapid turbine advancements have persuaded many operators to repower with larger or higher-efficiency turbine units rather than invest in life extension projects.

In the U.S., short-term tax credit deadlines have accelerated repowering activity. GE, for example, has repowered 4 GW of onshore wind capacity at 2,500 turbines since 2017, and expects to repower a further 3 GW by the end of 2020, the company said in May.

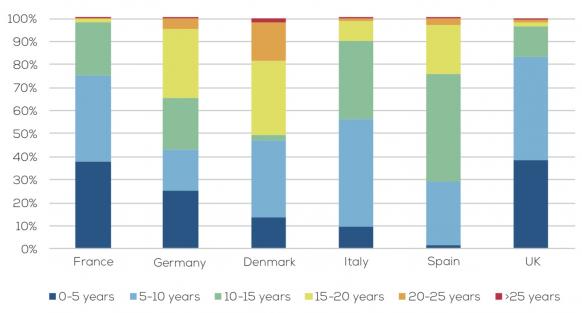

In Europe, new EU-level legislation adopted this year is set to accelerate demand for life extension and repowering on Europe's ageing wind fleet, industry experts told New Energy Update earlier this year.

Wind turbine ages in Europe

(Click image to enlarge)

Source: WindEurope, August 2018.

For the 40-year certified turbines, repowering will continue to be an option provided it is economically viable, Judge said.

The difference here is that "40-year turbines come with the first 20-year life extension from the start,” he said.

By Neil Ford