Germany’s ENBW enters California offshore wind; Tech giants align to remove contract barriers

Our pick of the latest wind power news you need to know.

Related Articles

ENBW enters US offshore wind market, in California

Germany's ENBW has entered the North American offshore wind market by joining Trident Wind's project to build up to 1 GW of floating wind capacity off the coast of central California.

ENBW has created a regional subsidiary, EnBW North America, and formed a joint venture with Trident Wind to advance the proposed 650 MW–1,000 MW Morro Bay offshore wind project.

"The initial focus of the joint venture is to obtain the site lease from the Bureau of Ocean Energy Management [BOEM] and on securing the grid connection which became available following the shutdown of the Morro Bay power plant," ENBW said in a statement June 11.

ENBW is already active in the European offshore wind market and recently won its first Asian project in Taiwan. In April 2017, ENBW and Denmark's DONG Energy became the first offshore wind power developers to acquire concessions at unsubsidized prices, bidding prices of zero euros per MWh to build wind farms in German waters.

Floating wind technology represents the future of offshore wind, according to ENBW. The group sees California as a key growth market for offshore wind, citing its "strong economy, continuously growing energy demand and ambitious renewable energy and climate goals."

Tech groups join forces to improve renewables PPA regulation

Leading global technology companies have become steering group members of Europe's RE-Source Platform, which pools resources to accelerate regulatory changes to accommodate corporate wind and solar energy contracts.

Google, Microsoft, IKEA Group, BT, Danone, Amazon, Enel Green Power, Engie, RES, Novartis, Iberdrola and Facebook, Inc, have all joined the scheme, industry groups WindEurope and SolarPower Europe announced June 6.

The RE-Source Platform aims to accelerate wind and solar investments by improving regulatory frameworks for corporate renewable power purchase agreements (PPAs). In some European countries, regulatory barriers have hampered PPA negotiations.

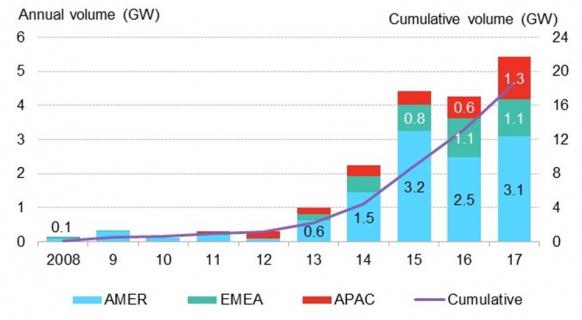

Technology groups have led a recent surge in renewable PPA activity. Over 1 GW of renewable PPA deals were signed in Europe in 2017 and the potential for more is "huge," WindEurope and SolarPower Europe said. In comparison, U.S. wind developers signed 3.6 GW of power purchase agreements (PPAs) in the first quarter of 2018 alone, the highest level recorded to date, the American Wind Energy Association (AWEA) said May 4.

Global corporate renewable PPA volumes

Source: Bloomberg New Energy Finance (BNEF).

“As the world’s largest corporate buyer of renewable energy, we are excited to support the RE-Source platform to accelerate the growth of renewables in Europe,” Marc Oman, Senior Lead, Energy and Infrastructure, Google, said in a statement.

"We look forward to being part of the RE-Source Platform, which brings together a multitude of stakeholders and voices committed to advancing regulatory frameworks that enable more corporate investments in renewable energy, taking us ahead in our journey towards a greener Europe,” Adina Braha-Honciuc, Government Affairs Manager at Microsoft, said.

Germany to remove price advantage for citizen-owned wind developers

Germany is planning to reset rules for wind power tenders to remove an advantage held by projects backed by community groups, Bloomberg reported May 31.

Germany is currently tendering around 2.8 GW of onshore wind capacity per year and projects backed by community groups won the majority of capacity tendered in 2017. Under the auction rules, community projects did not require a permit when they bid and had 54 months to secure the documentation. In July 2017, Germany allocated 1.0 GW of wind power capacity and 95% of the total accepted volume was from community-owned bids.

This price advantage was removed for auctions in 2018, in which commercial developers gained a larger share of the capacity. These changes will be implemented through a law amendment, possibly enforced before the summer, Bloomberg reported, citing Parliamentary officials close to the government.

New Energy Update