US tariffs slice 7.6 GW off solar forecast; Corporate PPAs rise 26% in 2017

Our pick of the latest solar news you need to know.

Related Articles

Trump's solar panel tariffs to wipe out 7.6 GW of new build

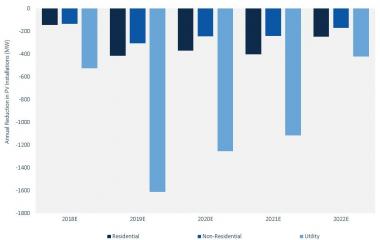

Import tariffs on solar panels imposed by President Trump on January 22 are forecast to cut PV installations in the next five years by 11%, or 7.6 GW of capacity, GTM Research said.

Some 65% of this reduction will come in the utility-scale sector, the research firm said.

Trump agreed a 30% tariff on crystalline-silicon solar cells and modules, which steps down by five percentage points each year to 15% in the fourth year. Some solar panel products seen as alternatives to crystalline silicon may be exempt from the tariffs, pending U.S. government review.

The biggest impact of the tariffs on utility-scale installations will be seen in 2019, for which GTM Research cut its forecast by 1.6 GW.

An estimated 2 to 3 GW of modules have been set aside for ongoing projects, limiting the tariff impact in 2018, the research firm said.

Reductions in PV installations due to tariffs

(Click image to enlarge)

According to GTM Research, emerging solar states such as Texas, Florida and South Carolina will be particularly affected by the tariffs.

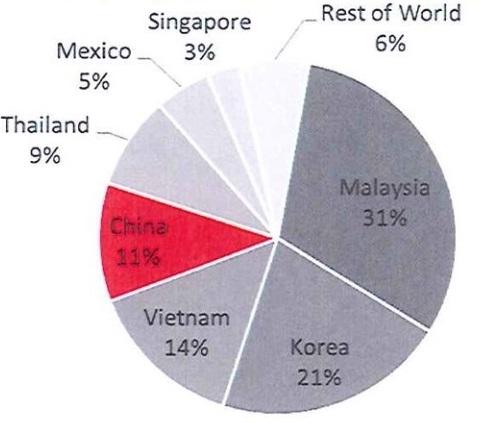

Trump's decision follows a case brought by Suniva and SolarWorld America. The plaintiffs argued low-priced panels from Asia are damaging the U.S. solar manufacturing industry.

The below graphic shows the global manufacturing bases most impacted by the tariffs.

US 2017 solar cell, module imports by country source

(Click image to enlarge)

23,000 US jobs

The Solar Energy Industry Association (SEIA) predicted the tariffs will cause the loss of 23,000 U.S. jobs this year, including manufacturing jobs.

Out of the 38,000 jobs in solar manufacturing at the end of 2016, only 2,000 were involved in the manufacturing of cells and panels, SEIA said. The remaining 36,000 manufacturing jobs were involved in metal racking systems, high-tech inverters, solar trackers and other electrical products, it said.

In total, the U.S. solar industry employed around 260,000 workers at the end of 2016, according to SEIA. Prior to the tariff case, sector employment was predicted to rise by around 10% in 2017 to 286,000.

"There’s no doubt this decision will hurt U.S. manufacturing, not help it,” Bill Vietas, president of RBI Solar in Cincinnati, said in a statement.

“The U.S. solar manufacturing sector has been growing as our industry has surged over the past five years. Government tariffs will increase the cost of solar and depress demand, which will reduce the orders we’re getting and cost manufacturing workers their jobs,” he said.

Abigail Ross Hopper, SEIA’s President and CEO, said the near-term impact would be severe but the industry would emerge from it.

"The case for solar energy is just too strong to be held down for long," Hopper said.

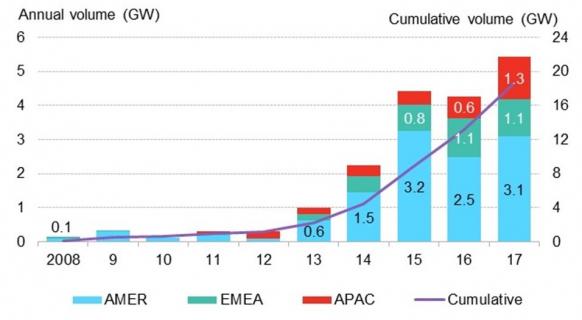

Corporate renewable PPAs rise 26% in 2017 to 5.4 GW

New corporate power purchase agreements (PPAs) for renewable energy rose by 26% in 2017 to 5.4 GW, driven by sustainability initiatives and falling renewable energy costs, Bloomberg New Energy Finance (BNEF) said January 22.

In the U.S., some 2.8 GW of PPAs were signed by corporations in 2017, up 19% year-on-year, BNEF said.

"The most notable of these deals was Apple’s 200MW PPA with NV Energy to purchase electricity from the Techren Solar project, the largest agreement ever signed in the U.S. between a corporation and a utility," it said.

In Europe, 1 GW of new corporate PPAs were signed, mainly in Netherlands, Norway and Sweden.

"In those countries, policy mechanisms allow developers to secure subsidies, while also giving corporations the ability to receive certificates to meet sustainability targets," BNEF noted.

Global corporate renewable PPA volumes

(Click image to enlarge)

The increase came despite regulatory uncertainty in the U.S. and Europe. Pending U.S. import tariffs on solar panels and changes to European renewable energy certificates have impacted the economic calculation of PPAs.

However, BNEF expects renewable energy PPA volumes to grow further in 2018.

"Commitments on the part of companies to use renewable electricity, including those made via the RE100 campaign, remain the most promising source of demand," BNEF said.

Under the RE100 initiative, companies pledge to source 100% of their electricity from renewables by a future date. Some 35 new companies signed up to the RE100 initiative in 2017, raising the total number to 119.

New France-Spain power line set to hike solar exports

European Union (EU) states have agreed to commit 517 million euros ($640.7 million) to the construction of a 2.2 GW interconnector between France and Spain, the European Commission (EC) announced January 25.

The EU grant is the largest ever awarded to a European interconnector project.

The new power line will raise France-Spain interconnector capacity to 5 GW, increasing the export opportunities for renewable energy operators.

The new power line will include a 280 km stretch offshore in the Bay of Biscay and underground cabling on the French land section.

"The new electricity link will better integrate the Iberian Peninsula into the internal electricity market...Such a leap will allow for an enhanced incorporation of renewable energies, thus contributing strongly to the clean energy transition and to the EU's clean energy transition policy," the EC said in a statement.

New Energy Update