US tariffs raise solar costs by 10%, says EIA; Canada pension fund takes control of Invenergy

Our pick of the latest solar news you need to know.

Related Articles

US solar tariffs to raise 2019, 2020 costs by 10%, 8.3% respectively

U.S. import tariffs on solar panels will increase the system cost of utility-scale PV systems entering service in 2019 by 10%, while projects starting up in 2020 will see costs rise by 8.3% and projects in 2021 will see a 6.7% lift, the Energy Information Administration (EIA) said May 14.

In January, President Trump approved a 30% tariff on imported crystalline silicon PV cells and modules. The tariff will start in 2018 and decline by five percentage per year and expire after 2021. The first 2.5 GW of imported solar PV cells are exempt from the tariff in each of the four years.

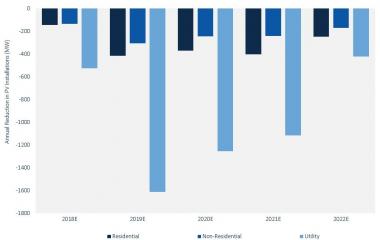

GTM Research has predicted the new import tariffs will cut PV installations in the next five years by 11%, or 7.6 GW of capacity.

According to EIA, the initial 30% tariff on the module component will raise system costs for 2019 projects by 10% and this impact will fall to 8.3%, 6.7%, and 5.0% for utility-scale solar PV projects entering service in 2020, 2021, and 2022, respectively.

"Prorated cost increases for residential solar PV equate to 4.0%, 3.1%, 2.5%, and 1.8% in 2019 through 2022, while non-residential end-use solar PV costs increase 6.0%, 4.6%, 3.7%, and 2.8% during the same time period," it said.

Impact of US import tariffs on solar installs

(Click image to enlarge)

Source: GTM Research (January 2018)

US study says high renewables will cut prices, transform market behaviour

A new qualitative study by the U.S. Berkeley Lab has shown that a high penetration of variable renewable energy (VRE) will profoundly impact hourly, daily and annual price patterns and could influence the economics of storage and electric vehicles.

Focusing on California's CAISO, Texas' ERCOT, the South-West Power Pool SPP, and New York's NYISO market, the researchers used capacity expansion and unit commitment models to generate hourly energy and ancillary service prices, and annual capacity prices, for scenarios with low and high VRE.

High wind and solar shares of 40-50% were compared against low renewable baselines reflecting 2016 levels.

"The most fundamental changes relate to the timing of when electricity is cheap or expensive and the degree of regularity in those patterns," Berkeley Lab said.

"With high solar shares in ERCOT, for example, prices slump in the middle of the day to an average of $10/MWh and then rise in the evening to an average of $80/MWh. These price dynamics may support electric-vehicle charging infrastructure at commercial sites that can be accessed during the day instead of residential charging that would occur at night," it said.

In the high VRE scenarios, the frequency of periods with electricity prices below $5/MWh increases to between 3% and 19% of hours, depending on the region and mix of renewables.

Average annual hourly wholesale energy prices decrease by $5-$16/MWh with high VRE, depending on the region and the mix of wind and solar.

"Decreases in average wholesale prices and common occurrences of periods with very low prices will affect the profitability of VRE and inflexible generators that operate in these hours, but also presents an opportunity to shift or increase demand at very low cost," Berkeley Lab noted.

The study also found that ancillary service prices soar with high VRE, particularly for frequency regulation and spinning reserve.

"Higher ancillary service prices could attract new market entrants such as batteries or incent wind and solar to offer these services themselves," Berkeley Lab said.

The qualitative study provides a foundation for planned quantitative evaluations of energy sector decisions based on low and high VRE futures, it said.

Canada's CDPQ acquires majority stake in Invenergy Renewables

Canadian public pension fund Caisse de depot et placement du Quebec (CDPQ) has increased its stake in Invenergy Renewables to 52.4% to gain majority control of North America's largest privately-held renewable energy company.

Invenergy operates 7 GW of wind, solar and gas-fired power capacity in the U.S. and 3 GW in other countries.

CDPQ initially invested in Invenergy wind farms in 2013 and a year later the investment group acquired a direct stake in the company. Since then, CDPQ has gradually increased its stake in the company.

“Over the years, we have seen [Invenergy's] impressive know-how, particularly in developing and operating projects, and its capacity to continuously innovate,” Rana Ghorayeb, Senior Vice-President, Investment, Infrastructure at CDPQ, said.

“The wind and solar energy sector is a promising one for CDPQ, and this investment is in line with our strategy announced last fall to increase our exposure to low-carbon assets,” he said.

The transaction is subject to regulatory approval.

Tunisia tenders for 500 MW of new solar capacity

Tunisia has launched a tender for 500 MW of solar capacity through five separate projects.

Developers are invited to submit proposals for a 200 MW project in Tataouine, 100 MW projects in Kairouan and Gafsa and 50 MW projects in Tozeur and Sidi Bouzid, the Tunisian energy ministry said in a statement.

The plants will be developed under a build own and operate (BOO) model.

Proposals will be evaluated based on the experience and track record of the bidders, financial terms, and construction and operations proposals, the government said.

New Energy Update