Solar developers predict price slump ahead of giant Saudi project

Installation and operations efficiencies and a shift in risk allocation will reduce Middle East solar prices further in the coming years and local industry buildout will be a challenge, leading PV developers told the MENA New Energy 2018 conference.

Related Articles

Saudi Arabia's recent memorandum of understanding (MoU) with Japan’s Softbank to develop 200 GW of solar power capacity in Saudi Arabia by 2030 stunned the renewables sector.

The move comes amid rapid falls in solar prices and the swift roll-out of Saudi Arabia's National Renewable Energy Program (NREP), which sets a target of 9.5 GW of renewable energy capacity by 2023.

In February, ACWA Power won Saudi Arabia's first international utility-scale PV tender at a record-low tariff price of 8.781 halalas/kWh ($23.4/MWh). The 300 MW Skaka PV project represents the first of a series of NREP tenders and the plant is scheduled to come online by 2019.

The Skaka tariff is over 20% lower than the ground-breaking price of $29.9/MWh agreed by the Dubai Electricity and Water Authority (DEWA) in 2016 for its 800 MW DEWA III project.

Technology innovations, improved construction methods and a better understanding of operations and maintenance (O&M) efficiency will reduce prices further in upcoming Saudi tenders, Paddy Padmanathan, President & CEO of ACWA Power, told the conference on April 25.

"There are a lot of improvements that are kicking in," Padmanathan said.

"Provided the base rate remains at where is today, or the base rate increases at a pace at which we are able to continue counter with all these improvements,...this trajectory will continue for the foreseeable future," he said.

Despite strong pressure on margins, Middle East developers predict increasing investor comfort for well-structured PV projects.

Going forward, the modular design of large-scale solar plants and increasing operational experience should allow for less onerous risk profiles, Suresh Bhaskar, Engie's Head of Business Development - Power and Gas Infrastructure Middle East, South and Central Asia, said.

Fossil fuel power projects currently achieve greater leverage on financing terms than PV projects, despite more complex designs and higher sensitivity to major component failure, Bhaskar noted.

"That is another area of improvement perhaps we could look into which can drive down the [PV] tariff," he said.

Scaling gains

The 200 GW target set by the Saudi Arabia-Softbank MoU could require around $200 billion in investment, according to reports. The proposed capacity would triple Saudi Arabia's electricity generation capacity from the 77 GW installed in 2016, according to data from Bloomberg New Energy Finance (BNEF). Around two thirds of the kingdom's electricity is currently supplied by gas-fired plants with most of the remainder supplied by oil-fired generators.

By setting a target date of 2030, the MoU partners can capitalize on global cost reductions and the emerging Middle East supply network. Solar development has expanded across the Middle East and North Africa and spurred innovations in plant installation and operations.

Middle East PV pipeline in 2018

(Click image to enlarge)

Source: Middle East Solar Industry Association (MESIA) – Solar Outlook Report 2018.

Further improvements in PV efficiency, plant design and increased component reliability could potentially see prices in the Middle East fall as low as $10/MWh, Nabih Cherradi, Chief Technology Officer at Desert Technologies, a Saudi Arabia-based panel manufacturer, told the conference.

The scaling up of vertically-integrated manufacturing companies and a focus on technology excellence would reduce module prices and could increase lifespans to over 40 years, Cherradi said.

"The technology is mature enough. We just have to think about the reliability of the materials that we are using," he said.

Local challenges

In emerging markets such as the Middle East, tenders must be sized and structured to support the development of a local solar supply network amid intense competition from global companies.

Tenders for very large projects can deter participants with smaller balance sheets, and tender criteria must balance the benefits of scale against the impact on competition, Padmanathan said.

"There is a point at which you need to size the procurement in order to get the best from the private sector," he said.

The current drive towards lower prices represents a challenge for the development of a local supply network in Saudi Arabia, Amaan Lafayette, CEO of NESMA Renewables, a privately-owned power developer, noted.

Local companies wishing to develop engineering procurement contractor (EPC) or subcontractor capabilities are facing price pressure at a relatively early stage of market development, Lafayette said.

"To participate fully and actively in that renewable energy program…it's a very squeezed place to be," he said.

Corporate offtake

Global growth in renewable energy corporate power purchase agreements (PPAs) is set to soon spread to the Saudi market. Rising retail electricity tariffs and the planned removal of diesel subsidies has heightened interest in renewable PPAs. Initially, PPA contracts may involve an aggregation approach to build up a sufficient level of hedged generation capacity to gain investor approval.

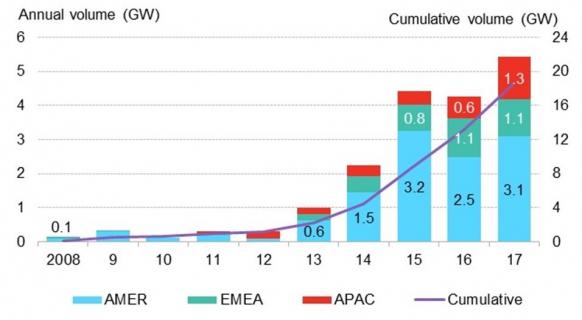

Global corporate renewable PPA volumes

(Click image to enlarge)

Source: Bloomberg New Energy Finance (BNEF).

Corporate PPAs could be implemented in Saudi Arabia in the next few years and this would represent a steep learning curve for the local electricity market, Padmanathan said.

Saudi Arabia participants will need to become comfortable with the structures of corporate PPAs and the transfer of risk within PPA contracts, he said.

"It's very much a space to watch,” Padmanathan said.

New Energy Update