PV to overtake wind in US corporate deals; Bifacial boom to double tracker market share

Our pick of the latest solar news you need to know.

Related Articles

US annual corporate PV demand to surpass wind in 2021

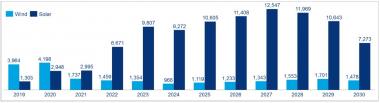

U.S. corporate demand for solar power is forecast to storm past wind power demand in 2021 and rise to ten times the demand for wind by 2024, according to a new report by Wood Mackenzie for the American Wind Energy Association (AWEA).

"Power market dynamics and the continued reduction of solar power’s [levelized cost of energy] are suppressing wind energy demand in the long term," Wood Mackenzie said in its report, 'Analysis of commercial and industrial [C&I] wind energy demand in the U.S.'

Wind, solar corporate demand (aggressive forecast)

(Click image to enlarge)

Wood Mackenzie report 'Analysis of commercial and industrial [C&I] wind energy demand in the U.S,' August 2019.

Recent cost reductions for solar and wind are luring new companies into corporate renewable contracts.

Tax credits are falling, but C&I renewable energy procurement is spreading as new sophisticated financial instruments help limit the risks of corporate power purchase agreements [PPAs], Wood Mackenzie said.

Battery storage deployment is set to improve the business case for solar power projects in the coming years. Storage trends are favoring solar plants over wind due to more predictable generation profiles, access to investment tax credits (ITCs) and smaller project sizes, the report noted.

"Absent of a step change in turbine performance or cost reductions, it is increasingly obvious that for wind to compete amidst ever increasing renewables penetration, a long-term energy storage solution must be developed to cope with wind’s weekly and seasonal boom/bust cycle," it said.

Bifacial boom to give trackers 40% of global PV market

Some 150 GW of PV tracking systems are forecast to be deployed globally between 2019 and 2023 and the share of trackers in the ground-mounted solar market will double to around 40%, consultancy group IHS Markit said in a new report.

Surging demand for bifacial modules will combine with efficiency gains and higher wattage for PV modules to drive growth in trackers in the coming years, IHS Markit said in its "Global PV Tracker Market Report 2019."

"Compared to standard mono facial modules, bifacial modules are generally expected to generate 5 to 20% more energy under optimal albedo conditions, with even greater gains reported for some case studies utilizing PV trackers," the consultancy group noted.

By 2020-2021 IHS Markit forecasts the price premium for bifacial modules "will become relatively insignificant compared to the efficiency gains," it said.

Tracker share of global ground-mounted PV

(Click image to enlarge)

Source: IHS Markit report 'Global PV Tracker Market Report 2019.'

The Americas will remain the largest market for trackers, accounting for 44% of the market, but the strongest growth will be seen across Europe, the Middle East and Africa (EMEA), IHS Markit said.

Surging demand in EMEA will be led by utility-scale PV deployment in Spain, UAE, Saudi Arabia and Egypt, it said.

Global PV tracker market by region 2019-2023

![]()

Source: IHS Markit report 'Global PV Tracker Market Report 2019.'

The EMEA region has historically been dominated by Spanish suppliers such as PVH and Soltec, which accounted for over 50% of PV tracker shipments to the region in 2018.

In the coming years, competition in EMEA will rise significantly "due to the persistence of other European suppliers such as Convert Italia, Ideematec, and NCLAVE (acquired by Trina Solar) in addition to the entrance of U.S. players such as NEXTracker and Array Technologies," IHS Markit said.

New Energy Update