Microsoft’s record solar purchase lowers risks for smaller offtakers

Microsoft's agreement to buy 315 MW from a 500 MW solar project in Virginia simplifies the acquisition of additional offtakers as falling costs attract new corporate buyers, Brian Janous, Microsoft's General Manager of Energy, told New Energy Update.

Related Articles

Microsoft announced March 21 it has signed a 315 MW solar Power Purchase Agreement (PPA) for SPower’s 500 MW Pleinmont project in the U.S. state of Virginia. The deal represents the largest corporate solar energy purchase in the U.S. to date and is Microsoft's seventh renewable energy PPA.

Falling solar and wind prices have boosted demand for long-term offtake contracts. U.S. corporate renewable energy PPA volumes hiked 48% in 2017 to 3.1 GW, according to the Rocky Mountain Institute (RMI). Global corporate renewable PPA volumes climbed 26% to 5.4 GW, according to Bloomberg New Energy Finance (BNEF).

Due online by 2019, the 500 MW Pleinmont solar farm will be the fifth largest solar PV project in the US. SPower CEO Ryan Creamer said the Microsoft deal had been a big help at a time of regulatory uncertainty. Since taking office in January 2017, President Trump has exited the global Paris climate accord, introduced import tariffs on solar panels, and looked to implement support schemes for conventional power generation.

SPower’s giant contract with Microsoft is expected to attract smaller firms to purchase power from the Pleinmont project.

Microsoft's strong credit rating will support project financing and allow the remaining production from the project to be sold at a “lower rate," Janous told New Energy Update.

The PPA structure is “unique” as the tech giant is acting as a de facto anchor tenant for additional transactions, Kevin Haley, Program Marketing Manager at Rocky Mountain Institute (RMI), said.

The agreement with Microsoft reduces the complexity and project development risks associated with negotiating multiple PPA contracts simultaneously, Haley said.

“This model helps avoid some of the complexities of a traditional aggregation deal structure, by allowing the developer to negotiate each PPA separately, as opposed to aligning individual off-takers under a single contract”, he said.

Green generation

The world's largest technology companies have spearheaded growth in corporate PPA deals in recent years.

Apple and Google recently announced they have purchased enough renewable energy to supply all of their global operations.

US corporate renewable energy deals

(Click image to enlarge)

Source: Rocky Mountain Institute (RMI), April 2018.

Cash-rich IT giants have embraced renewable energy for several reasons. Tech groups generally consume less power than energy-intensive industries, but the companies face rising power demand from datacenters.

Stable long-term prices offered by PPAs make them financially attractive, Neha Palmer, head of energy strategy at Google, told the Financial Times in a recent interview.

Google’s annual energy demand growth has been in double digit percentages in recent years and is expected to continue at a similar pace in the coming years, Neha said.

“Investing in renewables makes sense for our business,” she said.

Renewables projects also create local jobs and typically foster positive public relations.

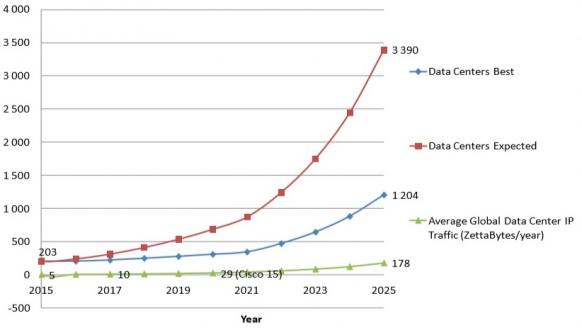

By the mid-2020s, datacenters will become some of the world's largest consumers of power, Brad Smith, President and CLO of Microsoft, said in a statement in 2016.

"We need to keep working on a sustained basis to build and operate greener datacenters," Smith said.

Forecast electricity demand for datacenters

(Click image to see full graphic)

Source: 2017 paper "Total consumer power consumption forecast" by Anders Andrae, Huawei.

Microsoft's deal with SPower deal means the technology group has now secured 1.2 GW of renewable capacity worldwide. The group has already achieved its 50% renewable energy target for datacenter consumption in 2018 and it aims to increase this to 60% by 2020.

New buyers

Dramatic reductions in solar and wind costs in recent years mean that a wider range of corporations are now turning towards renewable energy PPAs.

The proportion of corporate PPAs signed by tech companies has fallen from almost 100% five years ago to around 45% currently, according to RMI. General Motors, healthcare group Kimberley Clark, chemicals firm Solvay and drinks company Anheuser-Busch all signed U.S. renewable energy PPAs last year.

BNEF expects global renewable energy PPA volumes to grow further in 2018, following the 26% rise in 2017.

In the U.S., corporate renewable energy PPA deal flow in the first quarter of 2018 was equal to 40% of all deals in 2016, in terms of MW contracted, RMI data shows. This comes despite a lack of clear federal government support for renewable energy development.

Corporate commitments to renewable energy, including those made under the RE100 initiative, “remain the most promising source of demand" for corporate PPAs, BNEF said in January.

Under the RE100 initiative, companies pledge to source 100% of their electricity from renewables by a future date. Some 35 new companies signed up to the RE100 initiative in 2017, raising the total number to 119, BNEF said.

Smaller offtakers

Falling renewable energy prices could also attract smaller companies into the renewables PPA market.

In the absence of a larger offtaker such as Microsoft, the grouping of multiple smaller offtakers with differing credit ratings presents challenges for developers, Haley noted.

“Transaction costs tend to be higher, negotiations and sign-offs can take more time, and individual buyer profiles can add complexity,” he said.

Janous said Microsoft is considering new renewables contract structures and models that would support “fair market prices and access to renewables in every market.” The tech group is also looking at R&D projects such as wind plus storage and backup power to mitigate the intermittency of solar and wind plants, he said.

“Our purchasing power with these commitments should help open the market to all and green the grid”, he said.

By Neil Ford