E.ON clusters US renewables operations to tap new growth markets

E.ON's new state-of-the-art renewables operations center (ROC) in Texas illustrates how operators are using scale and digital technology to provide more sophisticated services in the growing operations and maintenance (O&M) sector.

Related Articles

The expansion of E.ON's central plant control activities in Austin highlights how operators are responding to the increasing market demands of growing wind and solar resources and the rising importance of O&M costs.

Open 24 hours a day, the center will control the scheduling and dispatching of North American wind and solar assets, remote management of renewable power and voltage, and a variety of third-party offtake agreements. E.ON currently owns and operates 3.6 GW of U.S. renewable energy capacity—mostly wind assets with a smaller share of solar-- and a further 2.9 GW of capacity owned by others.

The operations center will help drive up asset performance as E.ON expands into new electricity markets, Ray Manzanilla, Center Manager, told New Energy Update. Current assets are located in ERCOT (Texas), ISO New England, New York‘s NYISO, and the multi-state PJM, MISO and WECC electricity markets.

"We are expecting to expand the portfolio of resources and also manage assets in CAISO [California] and SPP [South-West Power Pool],” Manzanilla said.

The U.S. Energy Information Administration (EIA) predicts installed wind capacity will rise by 8.3 GW in 2018, to around 90 GW, pushing annual wind generation above hydroelectric output for the first time. Installed wind capacity is expected to rise by a further 8.0 GW in 2019.

GTM Research predicts 10.8 GW of new solar power will be installed in 2018, raising total solar capacity to around 64 GW. Some 6.6 GW of this new capacity will be utility-scale and this takes into account the Trump administration's import tariffs on cells and modules.

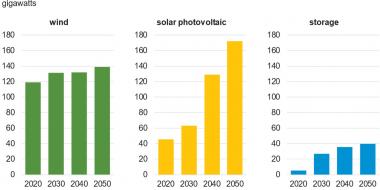

Forecast US renewables capacity (reference case)

(Click image to enlarge)

Source: Energy Information Administration's Annual Energy Outlook 2018.

E.ON has invested some $7 billion in renewables in North America over the past 10 years. Recent projects include utility-scale energy storage facilities on renewables sites and the group is developing a new 100 MW solar plant in Texas. The group plans further investments in the coming years, Manzanilla said.

“We continue to invest to keep up with the growth of renewable generation,” he said.

Cutting downtime

Growth in wind and solar capacity and falling project prices have led to a greater focus on maximizing energy yield. Operators are implementing the latest analytics solutions and spare parts strategies to minimize plant outages and reduce inventory costs.

E.ON's operations center will improve real-time plant monitoring during nights and weekends and "significantly“ reduce the number of maintenance callouts, the company told New Energy Update.

The centralized operation of multiple asset types allows E.ON to share management systems and 24-hour staffing resources.

Dispatch teams and remote operators use custom-built displays and the layout of the center improves team interaction, Manzanilla said, "so that realtime energy production is optimized and downtime of resources is reduced.“

Utility-scale energy storage installations are also on the rise as operators seek out new revenue streams in increasingly-connected markets.

E.ON already owns and operates storage capacity at wind and solar assets in Texas. In January, the company commissioned two 10 MW LG Chem lithium-ion batteries at its Pyron and Inadale windfarms. The battery systems will provide frequency response services to ERCOT, allowing E.ON to bid into the Fast Responding Regulation Service (FRRS) market any time of day, responding to events such as a large generator trip.

O&M growth

Falling wind and solar costs have raised the importance of O&M efficiency and accelerated competition in O&M services.

The wind O&M market is expected to grow dramatically in the coming years. U.S. wind farm owners are expected to spend over $40 billion on O&M over the next 10 years and suppliers such as Suzlon, Siemens Gamesa, MHI and Vestas are increasingly moving into the third-party servicing market, IHS Markit said in a report published in December 2017.

Ageing assets also bring additional O&M costs. The average age of wind turbines in North America is expected to rise from 5.5 years in 2015 to 7 years in 2020 and 11 years in 2025, IHS Markit said. O&M costs are forecast to rise from $45,000-$50,000/MW per year for turbines aged between five and 10 years, to around $50,000-$60,000/MW per year for turbines aged between 10 and 15 years, it said.

As the wind and markets mature, the removal or expiry of subsidies and the introduction of competitive power tenders will see more assets exposed to wholesale market risks.

A recent trend in developed wind power markets is the transfer of production risk to O&M providers, to better align the long-term economic interests of owners and service companies.

The wind industry is potentially heading towards revenue-based service guarantees where the service provider takes on performance, resource and market risk, Nicholas Rossel, Head of Business Development - O&M Mexico at EDF Renewables, told the Wind O&M Dallas 2018 conference in April.

"We are not there yet…Ultimately this will likely involve interplay between different entities, not just service providers but different types of vendors that come together to offer this," he said.

In the solar market, increasing cost competition and performance demands are prompting new contract terms between inverter suppliers and PV operators which prioritize long-term reliability and share revenue risk.

Growing fleet sizes are creating new opportunities for greater efficiency. Solar asset managers are investing in analytics, centralized spare parts warehousing and integrated energy storage to boost long-term plant efficiency.

Advanced inverter designs and modular power electronics could also place PV plants at the heart U.S. grid modernization plans, helping grid operators respond to challenges posed by growing renewables capacity and home energy systems.

Buying power

E.ON's operations center will also manage power supplied through power purchase agreements (PPAs) with utilities and energy consumers.

Falling wind and solar prices have boosted demand for long-term offtake contracts. U.S. corporate renewable energy PPA volumes hiked 48% in 2017 to 3.1 GW, according to the Rocky Mountain Institute (RMI), and higher levels are expected this year. U.S. wind developers signed 3.6 GW of power purchase agreements (PPAs) in the first quarter of 2018, the highest level recorded to date. Utilities accounted for 2.6 GW with corporate contracts representing 1.0 GW.

US corporate renewables PPA contracts

(Click image to enlarge)

Source: Business Renewable Centre's Deal Tracker (June 2018).

Growth in corporate PPAs was spearheaded by technology giants such as Apple, Facebook and Google but a wider range of businesses are now seeking these deals.

The proportion of corporate PPAs signed by tech companies has fallen from almost 100% five years ago to around 45% currently, according to RMI. Walmart, General Motors, healthcare group Kimberley Clark, chemicals firm Solvay and drinks company Anheuser-Busch all signed U.S. renewable energy PPAs in 2017-2018.

By Beatrice Bedeschi