Coronavirus cuts PV demand; lower loads lift operators' share

Our pick of the latest solar news you need to know.

Related Articles

Coronavirus cuts PV demand as Europe hit hard

The impact of the coronavirus pandemic on the global solar industry has shifted from a supply problem to a demand problem, as travel restrictions delay projects and economic uncertainty curbs investment activity.

IHS Markit now predicts annual global PV installations will fall 16% this year to 105 GW, the research group said March 31.

Europe could see a much larger drop, IHS Markit said. Previously, the group had predicted installations in Europe would rise by 5% in 2020 to 24 GW and Spain, Germany, Netherlands, France, Italy and Ukraine would account for 63% of demand.

Chinese solar manufacturing has resumed and could reach full capacity by mid-2020, but travel restrictions imposed by most major solar markets have delayed projects and cut short-term demand, IHS Markit said in its latest statement.

"Almost all large projects originally planned for completion in H1 2020 will be impacted in some way, and roof-top installations will grind to a halt. COVID-19 will also severely hit the planning and kicking-off of new projects in H2 2020," it said

IHS Markit predicts travel restrictions will be gradually lifted throughout the summer and solar activity will pick up in the second half of the year.

"However, the severity of the global economic downturn triggered by the pandemic will prevent a rapid recovery this year...the general financial environment will impact heavily on demand for all types of PV systems," it noted.

Following short-term disruption, IHS Markit predicts installation growth will resume from 2021 on the same growth trajectory that PV has seen over the last decade.

"Despite this major global health and economic crisis, we believe the mid-term fundamentals for solar PV growth continue to be strong, including continued cost reduction, the need for greater resilience and autonomy, low-carbon energy generation, distributed generation, and scalability," it said.

On March 26, the European Council of ministers called on the Council, the European Commission (EC) and the European Central Bank (ECB) to integrate the green transition into a compressive recovery plan for the COVID-19 pandemic. This will require a coordinated exit strategy and "unprecedented investment," the ministers said.

Germany loosens installation deadlines, retains tender dates

Solar developers in Germany will be allowed to apply for extensions to construction deadlines following the supply chain disruption caused by the coronavirus pandemic, Germany's energy regulator Bundesnetzagentur (BNetzA) said March 23.

As the coronavirus spreads across Europe, supply interruptions and travel restrictions have delayed projects. BNetzA is aiming to limit the penalties incurred by developers.

The dates of future renewable energy tenders in Germany remain unchanged, for now, BNetzA said.

Germany allocated 300 MW of new solar projects in March and will tender for a further 150 MW in June, followed by 300 MW in July, 400 MW in September, 150 MW in October and 400 MW in December.

BNetzA will inform the tender winners but will not publish the results online or enforce implementation deadlines until after the impact of the coronavirus has softened, the agency said.

In the Netherlands, solar and wind industry associations Holland Solar, NVDE and NWEA have called on the government to extend deadlines for project decisions by one-year.

Travel restrictions were impacting project schedules, Holland Solar said in a statement March 26.

"The shortage of manpower is the biggest problem and to a lesser extent the shortage of material," the trade group said.

Chinese solar manufacturing is ramping up and most solar power installers in the Netherlands have enough stock for about three months, allowing them to bridge the supply gap, it said.

US solar sector calls for coronavirus aid to minimize job losses

The impact of coronavirus on the US solar industry is deepening as the pandemic spreads across the country, the US Solar Energy Industry Association (SEIA) has warned.

The worsening pandemic has led to supply chain interruptions and labor shortages and 40% of solar companies had reported a reduction in workforce by March 26, a survey by SEIA showed.

Key concerns for solar companies include delays to project construction, supply chains and permitting, and a slump in customer acquisitions, SEIA said.

More than 63% of respondents were concerned they couldn't get access to tax equity, it said.

Congress failed to include explicit support measures for renewable energy companies in a new $2 trillion coronavirus aid package agreed March 25. Solar, wind and hydro industry groups had called on Congress to extend tax credit deadlines for renewable energy projects to prevent mass job losses.

"We are working with Congress to find solutions," SEIA said March 26.

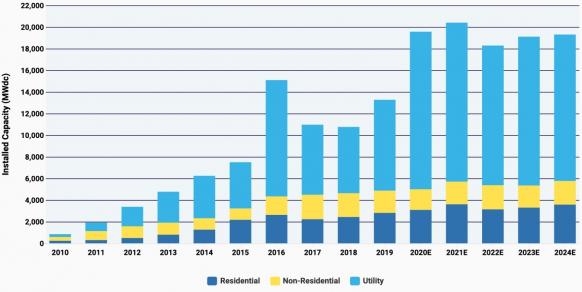

Before the crisis, US solar employment was forecast to rise by 7.8% this year to 269,500 jobs as new installations soared to record levels, the Solar Foundation said in its National Solar Jobs Census in February. Annual solar PV installations were forecast to rise by 47% in 2020 to almost 20 GW, SEIA and Wood Mackenzie said in a joint report. Growth would mainly be driven by the utility-scale market and total annual installations were expected to creep above 20 GW in 2021, SEIA said.

Employment in solar installation, the largest job sector, was expected to grow by 9.5% this year, adding around 15,000 jobs to the US economy, the Census showed. Employment in operations and maintenance (O&M) was expected to rise by 4%, equivalent to 463 new jobs nationwide, it said.

US solar installation forecast before coronavirus pandemic

(Click image to enlarge)

"This once again is testing our industry’s resilience, but we believe, over the long run, we are well positioned to outcompete incumbent generators...and to continue growing our market share,” SEIA said.

Coronavirus lockdowns slice power demand, hike renewables share

The escalating coronavirus pandemic has sliced power demand in Europe and the US, pushing down prices and increasing renewable energy share, data from grid operators show.

The closure of factories and offices has reduced business power demand and this has not been offset by residential demand. In some countries, travel restrictions could tighten in the coming days and weeks, further impacting power demand and asset operations.

In Germany, a manufacturing powerhouse, industrial demand could fall by up to 20% this year due to the coronavirus crisis, reducing power prices by as much as 7.8%, Enervis energy consultancy said. The share of renewable energy could rise from 42% to 45% this year, it said.

In the UK, the lockdown of all but essential workers reduced power demand by around 10%, increasing the share of renewable energy and putting some gas plants out of the money, the national grid said.

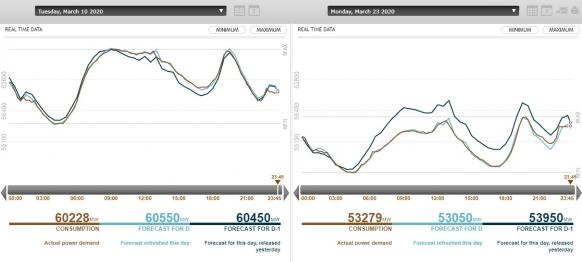

In France, national power demand has fallen 15% since self-distancing measures were put in place, national grid operator RTE said March 19. On March 17, France ordered people to stay at home unless they had to perform essential duties, after the closure of bars, restaurants and non-essential shops failed to limit congregations. On March 23, France enforced perimeter limits on civilians.

The lockdown has shifted daily demand patterns, creating challenges for forecasters, RTE said.

"There is no reference scenario that allows us to predict day-ahead demand as accurately as usual...RTE forecasters are having to adjust their forecasts in real-time," it said.

French power demand is rising more gradually than normal during the morning, hitting a lunchtime peak around 13:00 local time, then falling more sharply than usual in the afternoon ahead of the evening peak period, the grid operator said.

French power demand before, after lockdown

(Click image to enlarge)

Source: RTE (France's national grid operator)

In Italy, where coronavirus fatalities have soared, power demand fell by up to 9% following a nationwide quarantine March 13, according to S&P Global Platts Analytics.

In the U.S. ISO New England region, changes in behavior following the coronavirus outbreak had reduced power demand by 3 to 5% compared with normal levels, ISO New England said March 31.

"Our forecasters are seeing load patterns that resemble those of snow days, when schools are closed and many are home during the day. These patterns include a slower than normal ramp of usage in the morning, and increased energy use in the afternoon," the ISO said in an earlier statement.

"Though the pandemic is affecting energy usage, weather conditions remain the primary drivers of system demand," the operator noted.

"We will continuously monitor these ever-changing trends in load patterns, and make the appropriate adjustments to calculate an accurate load forecast," it said.

New Energy Update